Link para o artigo original : https://www.oaktreecapital.com/insights/insight-commentary/market-commentary/performing-credit-quarterly-4q2022

Featured Authors

Armen Panossian

Armen Panossian

Head of Performing Credit and Portfolio Manager

Danielle Poli, CAIA

Danielle Poli, CAIA

Managing Director, Multi-Asset Credit Product Specialist and Head of the Product Specialist Group

Performing Credit Quarterly 4Q2022: Bad News Bulls

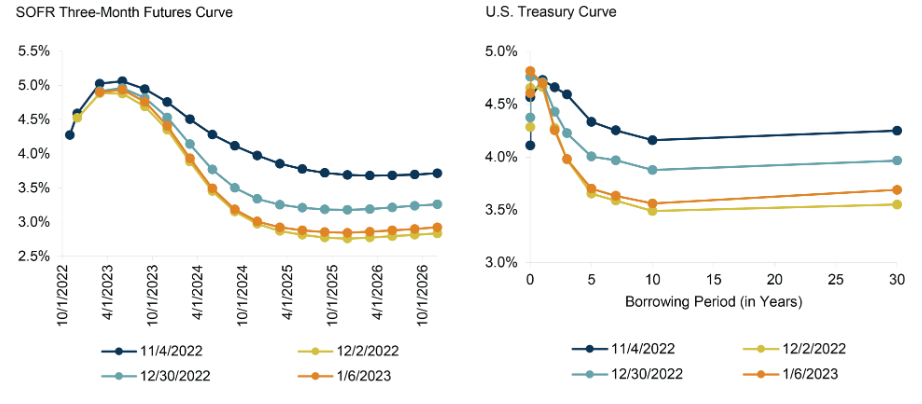

Investors’ views on inflation, recession risk, and monetary policy were fickle throughout much of 2022. However, in recent months, a positive bias has emerged, reflected in the downward shift in interest rate expectations and upward move in securities prices since mid-October.1 Investors increasingly appear to be interpreting economic data as evidence that a dovish pivot is imminent – i.e., the Federal Reserve will soon stop hiking interest rates and be in a position to cut them. As a result, bad news has become good news. Slowing job growth, dismal economic survey data, falling property values, negative real wage growth: It’s all good when viewed through the lens of inflation and monetary policy. While investors briefly turned more pessimistic about the likelihood of monetary policy easing following Fed Chair Jay Powell’s hawkish statements in December, the positive bias won out. By early January, futures markets were pricing in interest rate cuts of roughly 50 basis points in 2023 and almost 150 bps in 2024.2 (See Figure 1.)

Figure 1: Interest Rate Expectations Have Shifted Dramatically in Recent Months

Source: Bloomberg

But what has often been missing in this discussion of dovish pivots is the real economy and what may have to happen to it in order for this market narrative to play out. Because if investors get their wish and monetary policy changes dramatically in the next 12 months, it will likely be because this bad news has gotten a whole lot worse.

PAST THE PEAK?

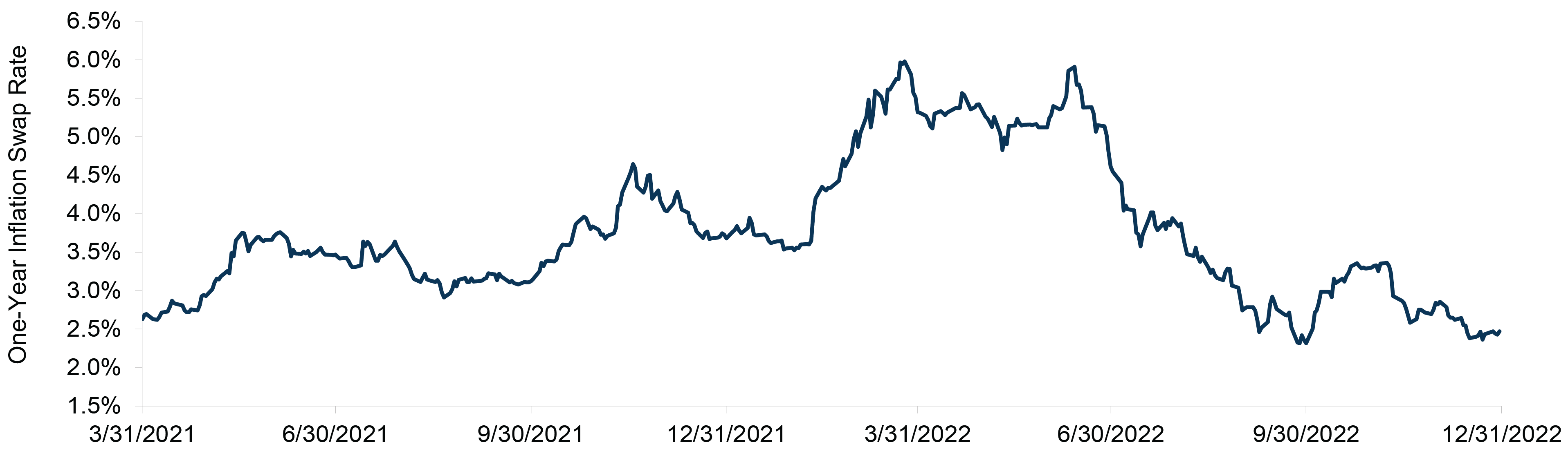

The dovish pivot narrative has obviously been driven by the expectation that U.S. inflation – which has fallen for six consecutive months – will continue to decline at a fairly rapid rate.3 In fact, at year-end, markets were anticipating that inflation would drop to 2.5% by the end of 2023. (See Figure 2.) On the one hand, it’s probably safe to assume that inflation has peaked for this cycle, given that (a) it has declined by 2.6 percentage points since June, (b) supply chains are mostly debottlenecked, (c) wage growth is slowing, and (d) many commodity prices have fallen to levels present before Russia’s invasion of Ukraine.4 However, it’s also noteworthy that the Fed’s success in slowing inflation thus far has occurred while China, the world’s second-largest economy, has been hampered by pandemic-related restrictions. While China’s full reopening will likely boost global economic growth, it could also exert upward pressure on global inflation.

Figure 2: Inflation Is Expected to Decline Rapidly

Source: Bloomberg

HISTORY LESSON

But even if inflation continues to slow, does this automatically mean the Fed will respond by lowering interest rates? Futures markets indicate that investors think (a) the neutral interest rate remains between 2.5% and 3.0% and (b) the Fed will seek to cut interest rates to this level even if there’s no pressing need to do so. But is this likely?

The history of the Fed suggests that it usually only shifts policy quickly in response to something bad, such as a credit crisis, economic downturn, severe market reaction, or, more recently, a global pandemic. The Fed is typically prone to keeping policy either too tight or too loose for too long. And like many institutions, it can sometimes be guilty of “fighting the last war.” So excessive tightness/looseness in one period can result in an overcorrection in the next.

Next, consider what the Fed is actually saying. In December, Chair Powell stated that the central bank doesn’t plan to loosen monetary policy any time soon and will likely have to make it even more restrictive to ensure inflation is brought under control. The Fed is likely concerned about prematurely claiming “mission accomplished” in part because the institution’s credibility has been damaged by the inflation spike in 2021-22 and the Fed’s claims that it would be transitory. Moreover, Fed officials only have to look back at “the great inflation” of 1965 to 1982 to see what can happen when policy is loosened too quickly.

Finally, it’s important to remember that the market is part of the system that the Fed is attempting to control. The markets’ optimism, which may be keeping financial conditions looser than the Fed would like, could make it more likely that the Fed keeps tightening policy. So, all things considered, the risk of over-tightening seems to be higher than the likelihood of a premature pivot.

THE REST OF THE STORY

So what would cause the Fed to make a significant shift in policy? As we noted above, history suggests that it would most likely be a meaningful recession or market crisis – risks that certainly aren’t being reflected in today’s earnings expectations or credit spreads. Investors appear to be focusing far more on what negative economic data means for interest rates than the potential implications for the real economy. When investors have reacted negatively to bad economic news – like the weaker-than-anticipated December retail sales data released in mid-January – the response has been short-lived, as concerns about recession risk have quickly turned into optimism about that much-desired dovish pivot.

Consider what the market has welcomed as good news:

- Wage growth is slowing. It’s understandable why investors and the Fed are happy with this development, given the impact that wages typically have on inflation. But it’s important to remember that the 4.1% increase in average wages in 2022 – robust as that might sound – was still well below the 6.5% annual rate of inflation.5 And even if inflation continues to slow in 2023, the related slowdown in wage growth is likely to keep consumers in the red for another year in real terms.

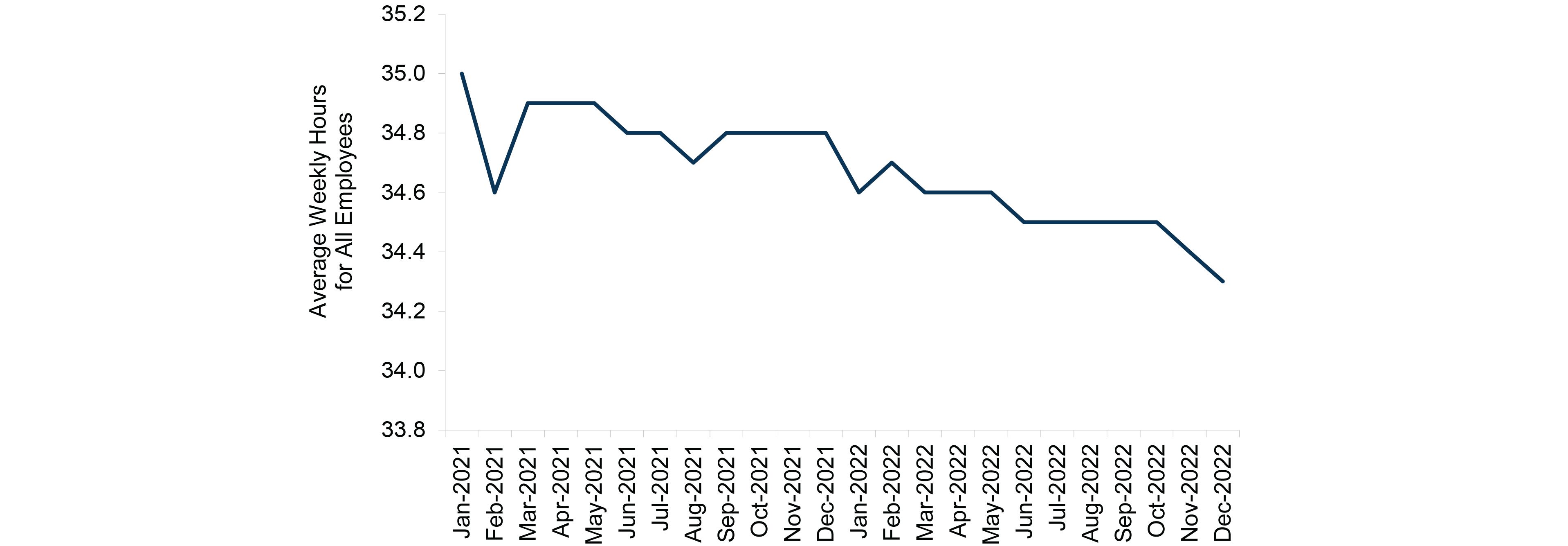

- The job market is weakening. While the unemployment rate has been hovering near the 40-year low of 3.5% for several months and job gains remain above the pre-pandemic norm,6 a look beyond the headline numbers reveals potentially negative trends. In December, average weekly hours per worker were down by 0.5 hours year-over-year, the equivalent of a loss of roughly two million jobs.7 (See Figure 3.) Moreover, the headline job gains might be slightly misleading, as more people appear to be holding multiple jobs, as indicated by the discrepancy between the job increases recorded by the establishment survey and the household survey. (Double counting is less likely in the latter.) These trends indicate that the labor market may be weaker than the low unemployment figure suggests.

Figure 3: Average Hours Worked in the U.S. Have Been Falling

Source: U.S. Bureau of Labor Statistics

- Savings are declining. Trillions of dollars of fiscal and monetary stimulus helped support consumers, businesses, and asset prices in 2020 and provided fuel for the recovery in 2021. While the economy slowed in 2022, consumption remained at fairly healthy levels for much of the year, partly because of the boost provided by the roughly $2.5 trillion in excess savings that households had accumulated during the prior two years.8 But the savings rate has now plummeted below the pre-pandemic level, largely because consumers’ purchasing power has been eroded by negative wage gains. (See Figure 4.) That means consumers have had to spend down a chunk of this excess savings and therefore may increasingly have to curb their spending.

Figure 4: The Personal Savings Rate Has Plummeted

Source: U.S. Bureau of Labor Statistics

- Reliance on credit cards is growing. The drop in the savings rate and spike in the cost of living have unsurprisingly been accompanied by an increased reliance on credit cards. In November, consumers’ use of revolving credit (primarily credit cards) rose by an annual rate of 16.9%. This wasn’t simply an anomaly caused by holiday spending, as this metric has risen by double-digit percentages in every quarter since 4Q2021.9 And this is occurring at a time when credit has become more expensive: The average annual percentage rate (APR) on credit cards rose to 22.7% in December.10

- Manufacturing and services activity appears to be slowing. The Institute for Supply Management’s surveys for both services and manufacturing indicated that activity contracted in December. Importantly, the former was the first such contraction since May 2020, and the latter was the second consecutive monthly contraction and the lowest level since May 2020. While the Atlanta Fed currently estimates that the GDP growth rate in the fourth quarter will be 3.5%, the near-term outlook for economic activity has clearly worsened.11

This is what is already occurring. In order for the Fed to shift gears meaningfully, these trends would likely have to get much worse. That would obviously be bad news for corporate fundamentals and could potentially reveal economic damage caused by the pandemic that was temporarily masked by government largesse. We can’t predict what will happen in the next 12 months, but we think investors who are waiting for an aggressive policy shift may discover that they should be careful what they wish for.

CREDIT MARKETS IN 1Q2023: KEY INSIGHTS

Where are Oaktree experts finding potential risks, opportunities, and relative value today? Going forward, Oaktree’s Performing Credit Quarterly will regularly highlight key insights that we believe investors should keep in mind when navigating today’s markets.

(1) We are in a credit picker’s market

In 2022, interest rate risk was the major driver of relative performance in fixed income, as evidenced by the outperformance of floating- versus fixed-rate asset classes.12 But we think this situation may change if the U.S. and other major economies slow. We believe that near-term default risk is low in most asset classes, as under 7% of outstanding bonds and loans are maturing before year-end.13 But we also think defaults are likely to increase from today’s ultra-low levels. Moreover, we believe we could see significant volatility – and dispersion based on quality – in many fixed income markets if investors’ optimistic assumptions aren’t borne out.

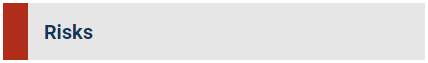

(2) A void has grown in the funding market for large private equity deals

Banks were saddled with billions in hung bridge loans in 2022 after investor appetite for this debt collapsed. Banks are now seeking to reduce risk on their balance sheets and are therefore underwriting few new large-scale financings for leveraged buyouts or mergers & acquisitions. Yet private equity sponsors are still seeking to complete deals, as they hold record-high amounts of dry powder. This has created attractive opportunities for those investors with the capital and flexibility to fill this void, as the average yield spread offered for such financings is larger than what is found in traditional middle market deals.14 Moreover, lenders are now in a position to secure significant investor protections, a situation that would have seemed impossible only one year ago.

(3) Fixed-rate bonds with long duration may offer attractive relative value

Investment grade and high yield bonds may become more attractive than loans in a weakening global economic environment, especially if investor concerns turn from interest rate risk to credit risk. In particular, we believe that bonds rated BB and higher may be appealing to investors, given their minimal credit risk, attractive yields, and limited near-term maturities. Importantly, the effective duration of BB-rated bonds is 4.4 years, meaning many of these issuers have locked in low borrowing costs for a significant period of time.15 However, the story is different for lower-quality issuers. The dramatic slowdown in high yield bond issuance in 2022 may signal trouble ahead for such borrowers, as they typically have shorter-duration debt and thus could face rollover risk in the coming years.16

(4) “Junk loans” remain a significant concern

While leveraged loans outperformed high yield bonds in 2022, they may be more vulnerable moving forward, given rising borrowing costs, high leverage ratios, and, in many cases, eroding fundamentals. We’ve already seen a meaningful increase in downgrades in recent months and a modest rise in defaults, albeit from a very low level.17 Looking forward, investors may face lower-than-anticipated recoveries when defaults do occur, due to the covenant-lite nature of most loans. (Over 90% of loans issued in 2021 and early 2022 had minimal investor protections.18) As we noted last quarter, “the longer the fed funds rate remains significantly above the 10-year average, the more likely it is that the cracks in loan fundamentals that we’re seeing could widen and eventually lead to greater instability and, potentially, a few collapses.”

(5) A potential sea change could create opportunities for bargain hunters

Many investors appear to believe that the macroeconomic conditions we’re seeing now, including a fed funds rate near 4.5%, are an aberration that will soon give way to a “normal” environment. That is, they think we’ll return to the conditions present after the Global Financial Crisis when interest rates were near zero. But let’s remember that those conditions are not the norm historically. We’ll give Howard Marks the last word on what might be in store for investors:

We’ve gone from the low-return world of 2009-21 to a full-return world, and it may become more so in the near term. Investors can now potentially get solid returns from credit instruments, meaning they no longer have to rely as heavily on riskier investments to achieve their overall return targets. Lenders and bargain hunters face much better prospects in this changed environment than they did in 2009-21. And importantly, if you grant that the environment is and may continue to be very different from what it was over the last 13 years – and most of the last 40 years – it should follow that the investment strategies that worked best over those periods may not be the ones that outperform in the years ahead. (Sea Change)

ASSESSING RELATIVE VALUE

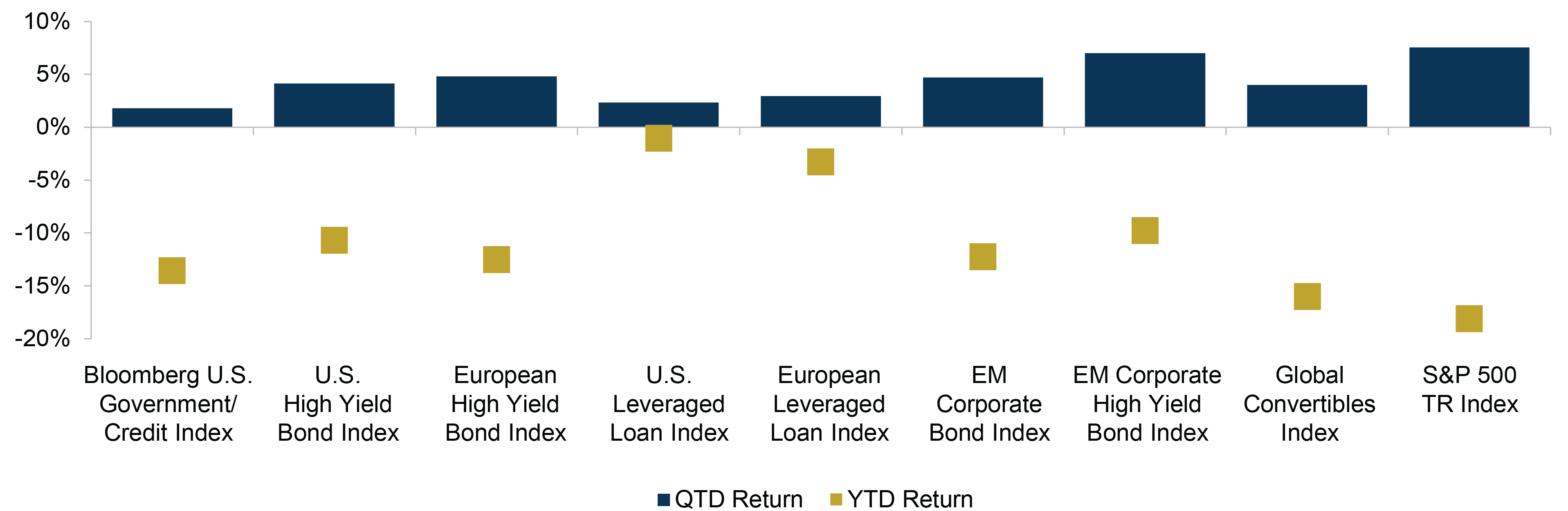

PERFORMANCE OF SELECT INDICES

As of December 31, 2022

Sources: Bloomberg Barclays, Credit Suisse, FTSE, ICE BofA, JP Morgan, S&P Global, Thomson Reuters19

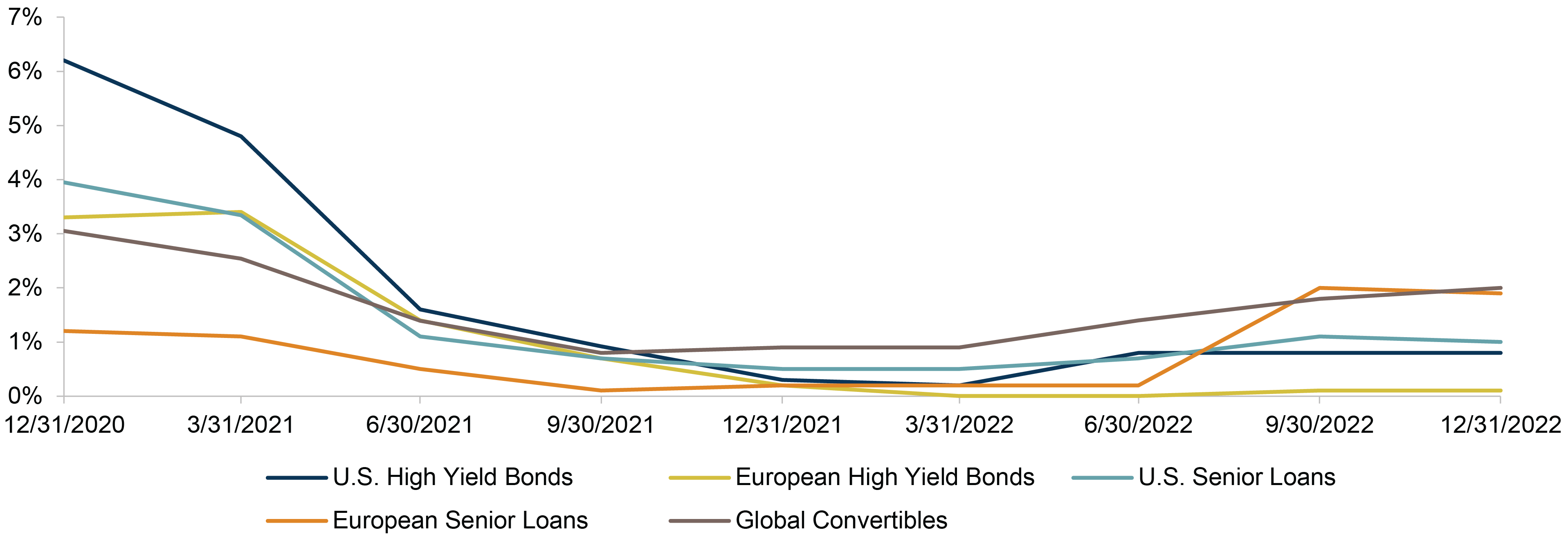

DEFAULT RATES BY ASSET CLASS

Sources: Bank of America, Credit Suisse, JP Morgan

Note: Data represents the trailing-12-month default rate; doesn’t include distressed exchanges

STRATEGY FOCUS

High Yield Bonds

Market Conditions: 4Q2022

U.S. High Yield Bonds – Return: 4.0%20 | LTM Default Rate: 0.8%21

-

Moderating inflation and better-than-feared earnings pushed fixed-rate asset prices higher in 4Q2022: High yield bonds rallied in the first two months of the period, more than offsetting the weakness in December.

-

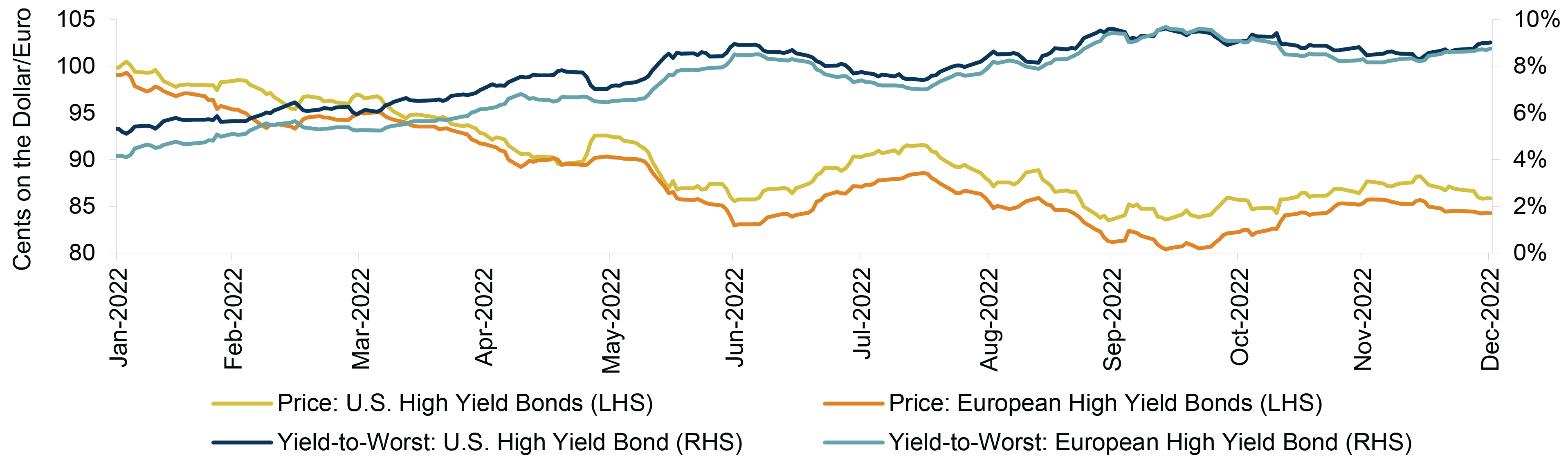

Yields remain elevated despite the rally: While yields declined during the period, they increased by 470 bps for the full year.22 (See Figure 5.) Approximately 72% of U.S. high yield bonds offered yields above 7% at quarter-end, compared to less than 7% at the beginning of 2022.23

-

Yield spreads narrowed during the quarter but remain relatively wide: Spreads in the asset class contracted by roughly 60 bps, but they expanded by 170 bps during FY2022. Yield spreads were near 500 bps at quarter-end,24 the level that typically indicates growing stress in the market.

European High Yield Bonds – Return: 4.7%25 | LTM Default Rate: 0.1%26

-

The asset class rebounded in 4Q2022: The recovery was particularly notable in long-duration credits, which were severely weakened by rising interest rates earlier in the year.27

-

The spread premium versus U.S. high yield bonds shrank: The European asset class’s advantage declined to 86 bps at year-end from a high of 174 bps earlier in 2022.28

-

The risk of widespread defaults in 2023 remains low: While analysts anticipate that default rates in the U.S. and European markets will rise in 2023, they expect that these rates will remain below their long-term historical averages in the near term.29 Issuers’ fundamentals are fairly healthy despite the slowdown in economic growth, and near-term maturities are minimal following the wave of refinancings in 2020–21.

-

Quality in the high yield bond market improved over the last decade: The percentage of BB-rated bonds in the U.S. market is near a 10-year high, while the number of CCC-rated credits has declined over the period.30 Thus, the asset class appears to be better positioned to weather an economic downturn than in the past.

-

Tightening monetary policy could harm heavily indebted companies: Low-rated corporate issuers might struggle to roll over debt if rising interest rates and quantitative tightening slow the economy and cause financial conditions to become restrictive. This could result in higher-than-expected default rates.

-

Elevated inflation could impair issuers’ fundamentals: Companies may be unable to pass along price increases to customers. Reduced earnings could negatively impact leverage ratios and potentially lead to credit rating downgrades.

Figure 5: High Yield Bonds Are Offering Potentially Attractive Yields and a Low Average Price

Source: ICE BofA US High Yield Constrained Index and ICE BofA Global High Yield European Issuers Non-Financial Excluding Russia Index

Senior Loans

Market Conditions: 4Q2022

U.S. Senior Loans – Return: 2.3%31 | LTM Default Rate: 1.0%32

-

U.S. loans rallied in 4Q2022, as new issuance remained low: During the period, loans outperformed most other asset classes and experienced far less volatility. However, performance in the loan market could be more volatile than usual moving forward if economies continue to weaken.

-

Retail investors reduced their exposure to the asset class: Despite positive performance, loan mutual funds and loan ETFs recorded eight consecutive months of outflows through December. Outflows in 4Q2022 totaled $11.4bn.33

European Senior Loans – Return: 2.9%34 | LTM Default Rate: 1.9%35

-

Performance differed based on credit quality: Despite broad market strength, several credits with weak fundamentals still experienced material losses, which dragged down the performance of CCC-rated loans.

-

The recent rebound has reduced the spread premium versus U.S. loans: The yield spreads on European loans are still slightly wider than those in the U.S. market. Additionally, the price of European loans is slightly below that of U.S. loans.

-

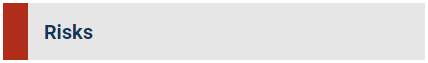

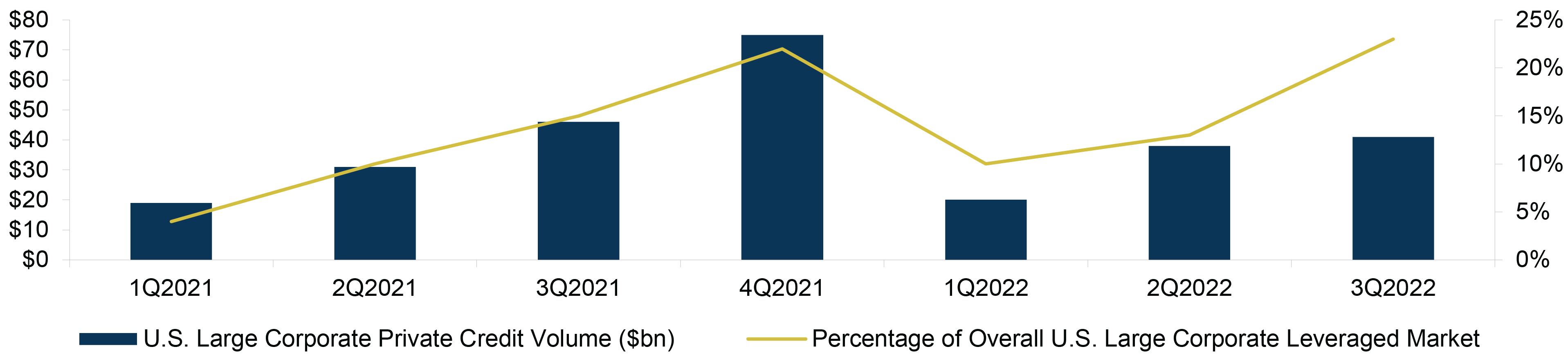

Rising interest rates may support relative performance: The spike in reference rates could make floating-rate loans more attractive relative to fixed-rate assets. (See Figure 6.)

-

Loans’ core buyer base is stable: Volatility in loans is usually lower than in other asset classes because (a) CLOs – the primary holders – have limited selling pressure and (b) the asset class tends to attract long-term institutional investors due to the lengthy cash settlement period.

-

Low issuance could support performance: Activity in the primary market is expected to remain limited through 2Q2023.36 The performance of existing loans typically benefits when the supply of new loans shrinks.

-

Rising interest rates may be especially burdensome to heavily indebted borrowers: The reference rates used in many loan contracts have risen significantly, so borrowers that didn’t hedge their interest rate risk could struggle to service their debt.

-

High inflation could harm companies’ fundamentals: While inflation has moderated, it remains elevated. Borrowers may struggle to pass along cost inflation to customers, which could negatively impact companies’ earnings and leverage ratios.

-

Economic growth may slow, increasing the likelihood of downgrades and defaults: Downgrades in the U.S. exceeded upgrades by $113bn in 2022.37 Many strategists expect defaults to increase in 2023, though from a low level.38 The risk over the medium term is growing, highlighting the importance of disciplined credit selection.

-

Loan quality has declined in recent years: Issuer-friendly loans may have encouraged imprudent borrowing, which could prove problematic in an economic downturn.

Figure 6: Reference Rates for Floating-Rate Loans Have Spiked

Source: Bloomberg

Emerging Markets Debt

Market Conditions: 4Q2022

EM Corporate High Yield Bond Return39 – 4Q2022: 7.0% | FY2022: -9.8%

-

EM bonds rallied in 4Q2022: EM debt benefited from moderating interest rate expectations and optimism about the resilience of the global economy. Additionally, the asset class was boosted by market technicals and optimism regarding China’s economic reopening.

-

Outflows from EM debt funds moderated, while new issuance stalled: Outflows slowed in 4Q2022 following significant activity in the prior quarter. Outflows in 2022 totaled more than 10% of the market’s AUM, which is similar to the percentage in the U.S. high yield bond market. Primary market activity in 2022 declined by over 60% year-over-year.40

-

Policy shifts could help China’s economy and bond market recover: China’s high yield bond market nearly halved its 9M2022 loss in 4Q2022, after the Chinese government ended its zero-Covid policy and announced enhanced policies to support the country’s real estate sector.41 Investors are focused on the global trade implications of China’s economic reopening, though it has been delayed by a surge in Covid-19 cases.

-

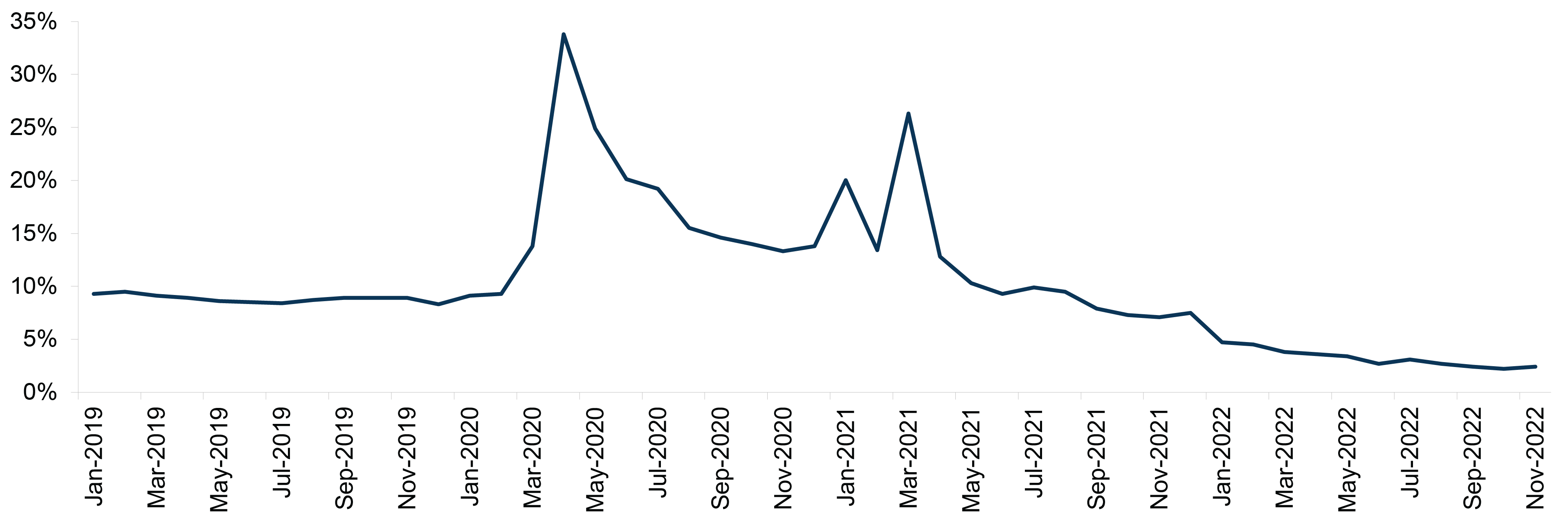

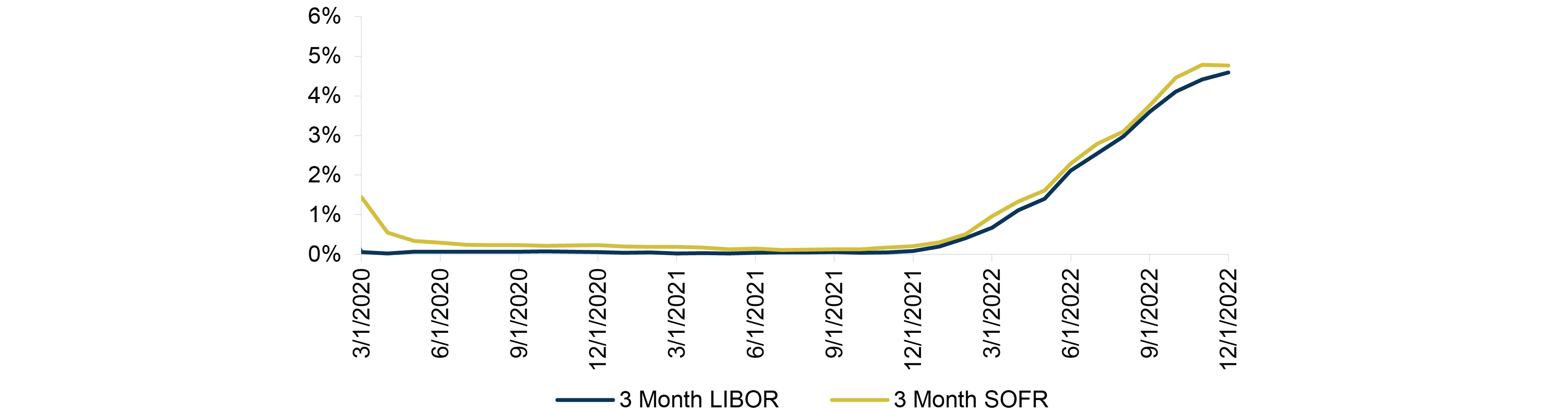

The EM high yield bond corporate default rate at year-end was 14%, the second-highest ever, but default rates varied between regions:42 The asset class recorded a default rate of only 1.8%, excluding Russia, Ukraine, and Chinese real estate.43 (See Figure 7.) Default rates in Latin America and the Middle East & Africa remained fairly low. However, the volume of bonds trading at distressed levels is double the amount at year-end 2021, 44 and the war in Ukraine, global economic weakness, and tight global financial conditions continue to pose significant risks to EM borrowers.

-

Broad market weakness and negative sentiment may create compelling buying opportunities: Investor allocations to EM corporate bonds are at multi-year lows, partly because crossover investors have been attracted by the relatively high yields that can now be earned in developed markets. This has caused a significant amount of EM debt, including that of fundamentally sound issuers, to trade at dislocated prices.

-

Active management could be beneficial in this challenging environment: Extensive credit analysis may enable investors to identify securities that offer attractive risk-adjusted return potential. EM capital markets are demanding large new issue premiums from everyone except blue-chip issuers. Companies that can generate consistent cash flow may be well positioned in an environment where access to U.S. dollar financing is limited.

-

Credit investors’ risk aversion may worsen already-difficult market conditions: If the global economy slows, outflows from EM debt retail funds may accelerate, and primary market activity may not recover, increasing already-elevated refinancing risks.

-

Developed market central banks may continue to tighten monetary policy: If current tight financial conditions worsen or persist longer than expected, EM countries and companies may struggle to roll over and service debt denominated in U.S. dollars.

-

Headwinds impacting EM economies could intensify: The war in Ukraine, rising populism in Latin America, and macroeconomic instability in Turkey could all erode investor confidence in EM credit.

Figure 7: Default Rates in EM Corporate Debt Vary Significantly by Region

Source: JP Morgan EM Default Monitor, as of December 31, 2022

Global Convertibles

Market Conditions: 4Q2022

Return: 4.0%45 | LTM Default Rate: 2.0%46

-

The asset class rebounded in 4Q2022: Global equity markets rose during the period, particularly in November, which caused convertible bond prices to increase. The rally was primarily driven by (a) expectations that inflation may have peaked, (b) optimism that the pace of Fed tightening could slow, (c) better-than-expected corporate earnings, and (d) China’s earlier-than-anticipated economic reopening.

-

Growth-oriented equities underperformed: The convertibles market has significant exposure to high-multiple, high-growth issuers, which recorded significant losses in 2022 due to rising interest rates and slowing economic growth.

-

Primary market activity was healthy in 4Q2022 but weak in 2022 overall: 47 New issuance of convertibles globally totaled $13.4bn across 31 new deals during the period. However, full-year issuance was well below the totals in 2020 and 2021.

-

The convertibles universe remains broad and diverse: While primary market activity was limited for most of 2022, robust issuance in the previous two years created an expansive opportunity set for those seeking to locate value.

-

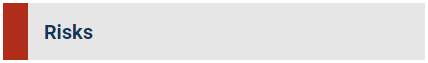

Issuers may increasingly turn to the convertible bond market in the coming year: Since the Global Financial Crisis, issuance of high yield bonds has dramatically outpaced activity in the convertibles market. (See Figure 8.) However, higher borrowing costs in the high yield bond market may now encourage issuers to turn to convertibles. As more borrowers migrate toward this market, the quality of new issuance should improve, potentially enhancing the average risk/return profile in convertibles.

-

Numerous trends threaten to slow global economic growth and weigh on equity prices: These include elevated inflation, low consumer sentiment, tightening global monetary policy, and geopolitical risk.

-

High-multiple equities remain vulnerable: Growth-oriented stocks may continue to weaken if U.S. interest rates keep rising or remain elevated.

Figure 8: The High Yield Bond Market Ballooned as the Convertibles Market Stagnated

Source: ICE BofA Non-Financial Developed Markets High Yield Constrained Index, ICE BofA U.S. Convertibles Index, as of October 31, 2022

Structured Credit

Market Conditions: 4Q2022

Corporate – BB-Rated CLO Return: 6.4%48 | BBB-Rated CLO Return: 4.8%49

-

Primary market activity was modest in 4Q2022: Issuance of collateralized loan obligations in the U.S. totaled $24.2bn in the period, a slight decrease from the 3Q2022 level.50 Issuance in 2022 totaled $130.3bn, significantly lower than the $183.7bn recorded in 2021.51 Primary market activity in Europe has been similarly muted: Just €6.1bn of CLOs priced during the quarter. 2022 issuance totaled €26.2bn, compared to €38.6bn in 2021.52

-

Risk appetite increased: The CLO market strengthened toward the end of the period, despite the challenging macroeconomic background, and CLOs significantly outperformed fixed-rate asset classes.53

Real Estate – BBB-Rated CMBS Return: -2.7%54

-

Primary market activity has continued to slow: Issuance of commercial mortgage-backed securities in 2022 totaled $100.3bn, compared to $157.1bn in 2021.55 Issuance in 2023 is expected to total only $85bn.56

-

Yield spreads have continued to widen, with some exceptions: Rising interest rates – and, relatedly, rising mortgage rates – weighed on commercial and residential real-estate-backed securities. Real estate debt was also negatively impacted by the slowdown in economic activity. However, the yield spreads of high-quality CMBS tightened, partly due to the moderation in inflation.

-

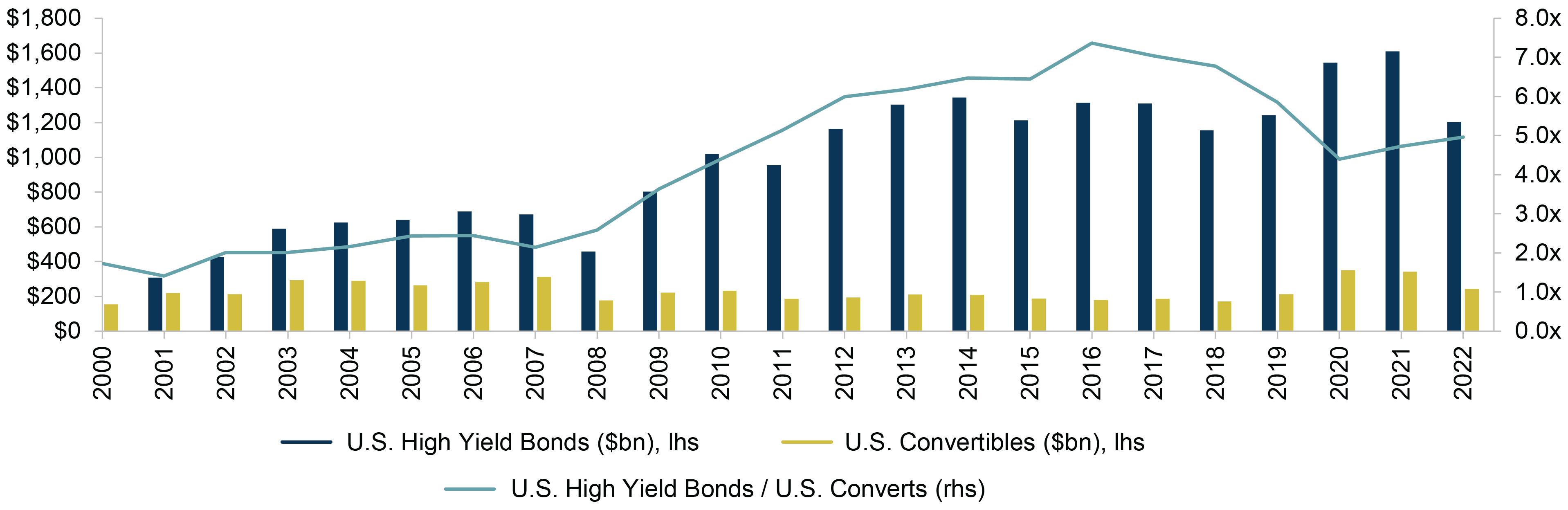

BB-rated CLO debt tranches have many sources of potential value: These instruments, and certain European BBB-rated CLOs, have attractive structural and credit enhancements as well as low sensitivity to interest rate increases. Structured credit continues to offer higher average yields than traditional credit asset classes. (See Figure 9.)

-

Asset-backed securities in certain categories may provide meaningful compensation for risk: Yield spreads for select aircraft and auto-related ABS may offer attractive value.

-

Weakness in real-estate-backed securities could create compelling opportunities for disciplined investors: The risk/return profiles for Single Asset Single Borrower CMBS and non-qualified mortgage-backed securities have become increasingly attractive. But we think maintaining disciplined credit analysis and remaining senior in the capital structure are extremely important in this challenging environment.

-

CLOs have historically performed poorly during bouts of equity market weakness: Performance could continue to be negatively affected by numerous factors, including high inflation, tightening monetary policy, slowing global growth, and geopolitical risks.

-

Primary market activity in real-estate-backed securities may remain limited due to widening yield spreads: Declining property values and slowing economic activity could exacerbate spread-widening. Issuers may be unwilling to offer the yields demanded by investors, which would limit the opportunity set.

Figure 9: Structured Credit Offers Higher Yields Than Most Traditional Debt

Source: Bloomberg Index Services, FTSE Global Markets, Credit Suisse, JP Morgan, as December 31, 2022

Private Credit

Market Conditions: 4Q2022

-

Private credit has benefited from investor demand for floating-rate debt: Rising interest rates have made private debt with floating rates appealing to investors, as coupons have increased. Floating-rate direct loans have historically performed well in rising-interest-rate environments.

-

Competition in private lending has declined: In 2H2022, many private lenders dramatically reduced their investment sizes or ceased making new investments altogether.57 We suspect this is partly because the portfolios of many direct lenders are beginning to show signs of weakness, as companies are facing declining revenues, shrinking margins, and high input costs. Furthermore, banks have become less willing to extend fund-level leverage to direct lenders.

-

The market has become less borrower-friendly: The reduction in the flow of capital into the asset class has forced borrowers to use less leverage and offer higher coupons and stronger lender protections than they did at the beginning of 2022.

-

Direct lending volume in Europe has declined but remains fairly healthy: While activity has slowed, the current level is comparable to that seen in 2021 and above levels recorded in 2020.58

-

Hung loan syndications are morphing into private deals: Banks are seeking to reduce risk on their balance sheets and are thus selling many leveraged-buyout-related loans in the private market at attractive prices. Banks are unlikely to underwrite new LBOs until the banks’ balance sheets stabilize. Direct lenders are beginning to fill the void created in the market. (See Figure 10.)

-

Pricing has increased and loan-to-value ratios have declined in new LBOs: 59 The cost of borrowing for new and existing LBOs rose in 2022, given widening spreads, rising base rates, and market dislocation. In the case of new deals, financial sponsors have been increasing their equity commitments beyond the typical 40% of enterprise value.

-

Rescue lending opportunities are increasing: The opportunity set could expand further if the economy continues to weaken and asset prices fall.

-

Opportunities in the non-sponsored market remain attractive: Average pricing and terms are superior to those in the sponsor-backed market.60

-

Credit fundamentals in several sectors are deteriorating: Consumer-facing companies are especially vulnerable, as it has become challenging to pass through price increases to customers. Cyclical industries are experiencing the most significant margin erosion.

-

Recession risk is increasing: If the U.S. economy contracts, private equity sponsors may not inject capital into struggling companies like they did in 2020–21. Sponsors may have already met their investment caps or believe they won’t earn a sufficient return.

-

Tightening monetary policy could negatively impact the lending environment: Higher interest rates may discourage new borrowing and make it challenging for current borrowers to refinance or extend their debt. This situation could make defaults more likely.

-

High inflation may persist longer in the UK than in other major economies: The Bank of England has warned that inflationary pressures may remain elevated, partly due to the country’s trade issues and limited energy storage capacity. Thus, the BoE may have to keep monetary policy restrictive for longer than other central banks, increasing the risk of a significant recession in the UK.

Figure 10: Direct Lenders Are Accounting for a Larger Share of Deal Volume

Source: Refinitiv

Investment Grade Credit

Market Conditions: 4Q2022

Return: 3.5%61

-

The asset class strengthened in 4Q2022, largely because inflation slowed and investors grew increasingly optimistic that the Fed’s rate-hiking cycle would soon be complete: U.S. Treasury yields remained relatively unchanged over the period.62 While the Fed continued to increase interest rates, these hikes were well telegraphed, and Fed Chair Jay Powell also indicated that the pace of tightening would likely slow.

-

Yield spreads narrowed during the period: Third-quarter corporate earnings were better than feared and investors continued to price in expectations of only a mild economic slowdown. The average yield spread in the asset class was roughly 140 bps at quarter-end, down 30 bps from the end of September but still up 40 bps for the year.63

-

Higher-quality credits have been resilient: Yield spreads of A-rated credits have widened less significantly than those of lower-rated debt.64 At quarter-end, the average price of A-rated bonds was near 90 cents on the dollar, and the yield-to-maturity was roughly 5.3%.65

-

Investment grade corporate debt yields rose significantly in 2022: Although yields declined slightly during the quarter (by roughly 20 bps), yields in the asset class ended the quarter at 5.5%.66 (See Figure 11.)

-

Rising recession risk may make investment grade debt attractive on a relative basis: Investment grade debt is likely to outperform high yield bonds if widening yield spreads – as opposed to rising Treasury yields – prove to be the primary driver of performance in credit markets in 2023.

-

Defensive sectors could potentially offer compelling value if the economy deteriorates: Sectors such as consumer staples typically outperform more growth-oriented sectors during economic downturns.

-

Inflation may remain elevated, putting pressure on the Fed to continue hiking interest rates: Tighter monetary policy and slowing economic activity should continue to temper inflation, but uncertainty remains about how quickly inflation will fall.

-

High input costs and slowing economic growth could weigh on corporate earnings: Issuers’ fundamentals remain fairly robust on average, but margin compression could negatively impact credit metrics and lead to credit rating downgrades and mark-to-market weakness.

Figure 11: Investment Grade Bond Yields Have Spiked as U.S. Treasury Yields Have Risen

Source: ICE BofA

OAKTREE’S PERFORMING CREDIT PLATFORM

Oaktree Capital Management is a leading global alternative investment management firm with expertise in credit strategies. Our Performing Credit platform encompasses a broad array of credit strategy groups that invest in public and private corporate credit instruments across the liquidity spectrum. The Performing Credit platform, headed by Armen Panossian, has $60.21 billion in AUM and approximately 190 investment professionals.67

ENDNOTES

1 Securities prices refer to S&P 500 Index, ICE BofA US Corporate Index, and ICE BofA US High Yield Constrained Index, as of January 23, 2023.

2 Bloomberg.

3 U.S. Bureau of Labor Statistics for inflation data.

4 U.S. Bureau of Labor Statistics for inflation data.

5 U.S. Bureau of Labor Statistics.

6 U.S. Bureau of Labor Statistics.

7 The two million figure is based on the following Oaktree calculations: 0.5 hours * 52 weeks = 26 hours * 160 million workers = 4.1 million / 2080 hours (1 FTE hours / year) = 2 million.

8 Board of Governors of the Federal Reserve System.

9 Board of Governors of the Federal Reserve System.

10 The Balance, as of December 31, 2022.

11 Federal Reserve Bank of Atlanta, seasonally adjusted annualized rate, as of January 20, 2023.

12 Credit Suisse, JPMorgan, FTSE.

13 Calculations based on data from Bank of America and Credit Suisse, as of December 31, 2022.

14 From Oaktree observations in the market, as of January 23, 2023.

15 ICE BofA US High Yield Constrained Index, as of December 31, 2022.

16 ICE BofA US High Yield Constrained Index, as of December 31, 2022.

17 JP Morgan and Credit Suisse, as of December 31, 2022.

18 S&P Leveraged Commentary & Data.

19 The indices used in the graph are Bloomberg Government/Credit Index, Credit Suisse Leveraged Loan Index, Credit Suisse Western European Leveraged Loan Index (EUR hedged), FTSE High-Yield Cash-Pay Capped Index, ICE BofA Global Non-Financial HY European Issuers ex-Russia Index (EUR Hedged), Refinitiv Global Focus Convertible Index (USD Hedged), JP Morgan CEMBI Broad Diversified Index (Local), JP Morgan Corporate Broad CEMBI Diversified High Yield Index (Local), S&P 500 Total Return Index, and FTSE All-World Total Return Index (Local).

20 ICE BofA US High Yield Constrained Index.

21 JP Morgan.

22 ICE BofA US High Yield Constrained Index.

23 ICE BofA US High Yield Constrained Index.

24 ICE BofA US High Yield Constrained Index for all data in this bullet.

25 ICE BofA Global Non-Financial High Yield European Issuer, Excluding Russia Index (EUR hedged).

26 Credit Suisse.

27 ICE BofA Global Non-Financial High Yield European Issuer Excluding Russia Index.

28 ICE BofA US High Yield Index; ICE BofA Global Non-Financial High Yield European Issuer Excluding Russia Index.

29 JP Morgan.

30 ICE BofA US High Yield Constrained Index.

31 Credit Suisse Leveraged Loan Index.

32 JP Morgan.

33 JP Morgan.

34 Credit Suisse Western Europe Leveraged Loan Index (EUR hedged).

35 Credit Suisse.

36 JP Morgan.

37 JP Morgan.

38 JP Morgan.

39 JP Morgan CEMBI Broad Diversified High Yield Index. The Emerging markets debt section focuses on dollar-denominated debt issued by companies in emerging market countries.

40 BofA Global Research.

41 JP Morgan CEMBI Broad Diversified High Yield Index.

42 JP Morgan EM Default Monitor.

43 JP Morgan EM Default Monitor.

44 JP Morgan.

45 Refinitiv Global Focus Convertible Index.

46 Bank of America.

47 Bank of America for all issuance statistics in this bullet.

48 JP Morgan CLOIE BB Index.

49 JP Morgan CLOIE BBB Index.

50 JP Morgan.

51 JP Morgan.

52 JP Morgan.

53 JP Morgan CLOIE BBB Index, JP Morgan CLOIE BB Index.

54 Barclays CMBS 2.0 BBB Index.

55 Barclays.

56 JP Morgan.

57 Based on Oaktree observations in the market, as of December 31, 2022.

58 Deloitte Alternative Lender Deal Tracker, as of September 2022.

59 All statements in this bullet are based on Oaktree observations in the market, as of December 31, 2022.

60 Derived from Oaktree estimates, as of September 30, 2022.

61 ICE BofA US Corporate Index.

62 U.S. Department of the Treasury.

63 ICE BofA US Corporate Index.

64 ICE BofA Single-A U.S. Corporate Index.

65 ICE BofA Single-A U.S. Corporate Index.

66 ICE BofA US Corporate Index.

67 The AUM figure is as of September 30, 2022 and excludes Oaktree’s proportionate amount of DoubleLine Capital AUM resulting from its 20% minority interest therein. The total number of professionals includes the portfolio managers and research analysts across Oaktree’s performing credit strategies.

NOTES AND DISCLAIMERS

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker dealer, investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

This document, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”). By accepting this document, you agree that you will comply with these restrictions and acknowledge that your compliance is a material inducement to Oaktree providing this document to you.

This document contains information and views as of the date indicated and such information and views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree believes that such information is accurate and that the sources from which it has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.

© 2022 Oaktree Capital Management, L.P.

Informações sensíveis e divulgação

Este memorando expressa as opiniões do autor na data indicada e tais opiniões estão sujeitas a alterações sem aviso prévio. A Oaktree não tem a obrigação de atualizar as informações aqui contidas. Além disso, a Oaktree não faz nenhuma representação, e não se deve assumir que odesempenho dos investimentos passados é uma indicação de resultados futuros. Além disso, onde quer que haja potencial de lucro, também existe a possibilidade de prejuízo. Este memorando está sendo disponibilizado apenas para fins educacionais e não deve ser usado para qualquer outro propósito. As informações contidas neste documento não constituem e não devem ser interpretadas como uma oferta de serviços de consultoria ou uma oferta de venda ou solicitação de compra de quaisquer títulos ou instrumentos financeiros relacionados, em qualquer jurisdição. Certas informações contidas neste documento sobre tendências econômicas e desempenho são baseadas ou derivadas de informações fornecidas por fontes terceirizadas independentes. A Oaktree Capital Management, L.P. (“Oaktree”) acredita que as fontes das quais tais informações foram obtidas são confiáveis; no entanto, não pode garantir a exatidão de tais informações e não verificou de forma independente a exatidão ou integridade de tais informações ou as suposições nas quais tais informações se baseiam. Este memorando, incluindo as informações aqui contidas, não pode ser copiado, reproduzido, republicado ou postado na íntegra ou parcialmente, em qualquer formato, sem o consentimento prévio, por escrito, da Oaktree.