The transition to green energy will be an increasingly important driver of economies and markets. In this research, we stress test the impact on investor portfolios of four broad mechanisms that could accelerate the climate transition.

Climate change appears likely to be one of the defining issues of the 21st century, affecting economies and markets in different ways. Here we will share some of our ongoing research on one of the important ways climate change is likely to impact investment portfolios in the near term: the potential for an accelerated transition to a low-carbon economy. Coming out of COP26 (which we discuss in the appendix), it looks to us like governments have a mandate for climate action, but there are still very substantial gaps to get to a successful transition trajectory (i.e., more climate action is probably ahead of us). So, it is important to monitor how the transition unfolds and stress test portfolios for the possibility of a climate transition that is more aggressive than currently discounted by markets.

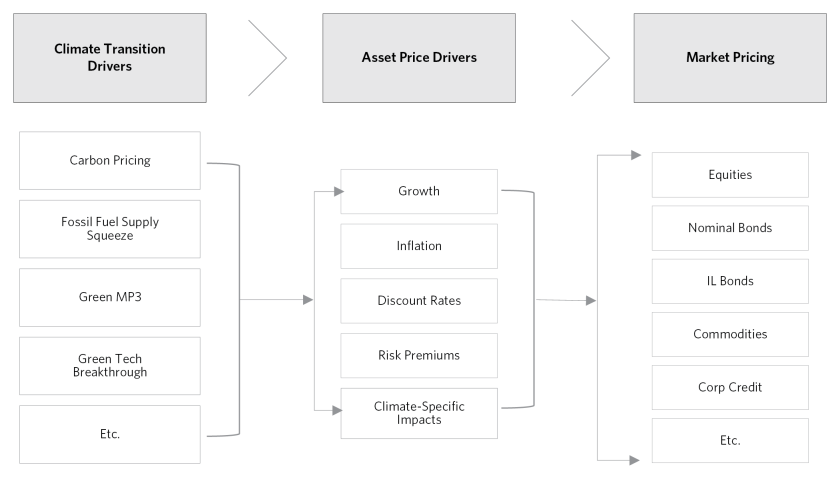

Like any other scenario, we believe investors can understand the potential impacts of a faster transition on their portfolios by breaking it down into its component pieces, studying the cause/effect linkages, and penciling out the flow-through to global economies and assets[1]. We group the wide range of possibilities into four broad mechanisms that could accelerate the climate transition and explore how each one would lead to meaningfully different impacts on economies and financial markets:

- Carbon Pricing: Raising the cost of carbon to reduce demand.

- Supply Squeeze: Limits on the supply of carbon-intensive energy.

- Green MP3: Governments borrow/print and spend directly on green initiatives.

- Green Tech Breakthrough: New technology dramatically reduces the cost of green energy.

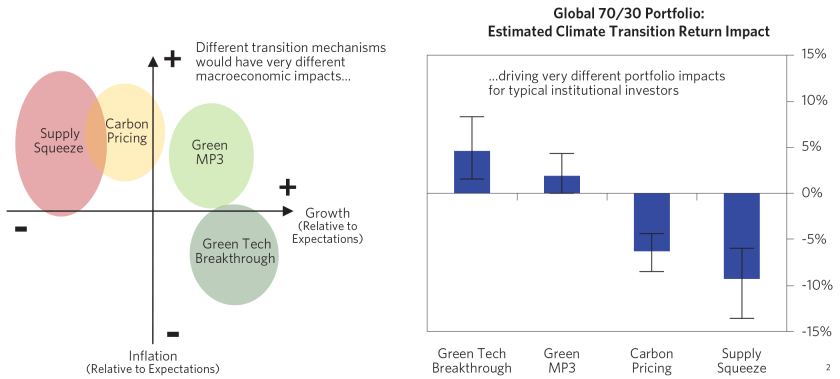

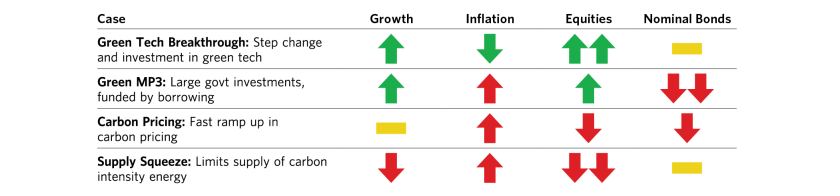

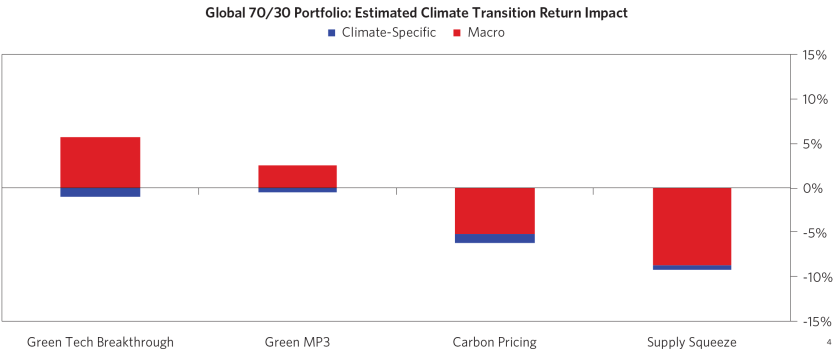

Each of these mechanisms could significantly reduce greenhouse gas emissions (which is essential for the climate transition) but would have very different impacts on economies and asset prices (e.g., Green MP3 would be stimulative, while a supply squeeze on fossil fuels could lead to energy shortages and slower growth). The charts below show these four climate transition mechanisms roughly mapped to their impacts on growth and inflation and our penciled-out expectations of the impact on traditional investment portfolios of a faster-than-discounted climate transition occurring through each of these mechanisms. We focus on growth and inflation because these macro drivers are likely to have significantly larger portfolio impacts than the relative winners and losers within specific markets.

1In previousresearch, we have explored other relevant dimensions of climate impact on markets and economies, such as green fiscal policy, the inflationary pressure of the climate transition, the physical risk impact on economies, the push tonet zero’s impact on oil markets, the decline of coal, the secular climate pressures on industrial metals, and the shift to electric vehicles.

Several of these climate pathways create real risk to traditional institutional investor portfolios, which are most vulnerable to transitions that are inflationary and bad for economic growth. So far, we have seen the transition currently unfolding in an inflationary manner, with rising carbon prices and supply squeezes as the primary methods being used to curb emissions. In the remainder of this report, we discuss these transition mechanisms and their likely impact on economies, assets, and portfolios in more detail.

Mapping Out the Cause/Effect Mechanisms That Could Accelerate the Climate Transition

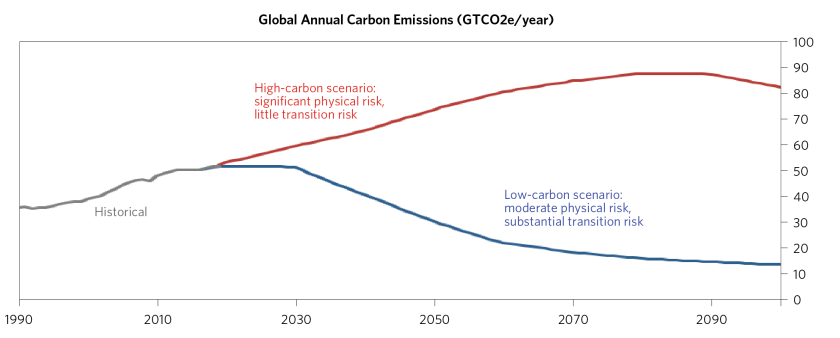

At the highest level, there are two components of climate change risk for investors. Carbon emissions could remain high or continue to rise, leading to increasingphysical riskover time (the red line in the chart below). Or the world could take meaningful steps to get carbon emissions to decline and mitigate long-term physical risk but createtransition riskin the interim (the blue line in the chart below). These are not binary options: in a muddle-through path, investors could be hit by both the impacts of accelerating transition-related policies and the impacts of increasing physical damages from climate change.

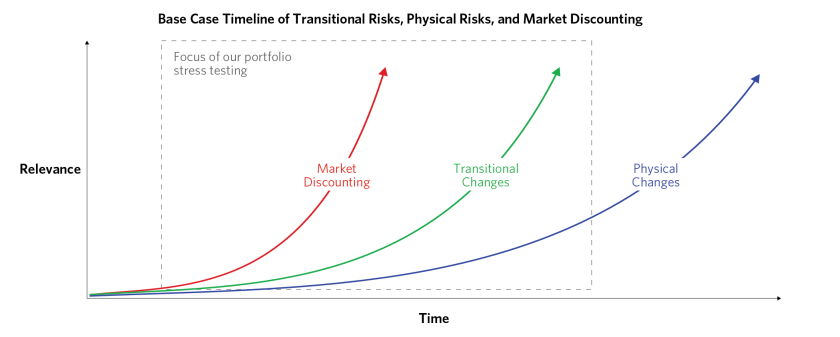

What matters to markets is how conditions transpire relative to what’s priced in, and this principle applies to penciling out the investment risks associated with climate change. With physical damages playing out over many years and in non-normally-distributed ways, it is difficult for markets to price them in adequately today. The climate scenario most likely to impact investment portfolios in the near term is the risk of a faster-than-expected climate transition becoming priced in.

It looks to us that governments increasingly have a strong mandate for a policy response to climate change—with strong public sentiment for climate action around the world, as well as global policy makers making climate transition commitments and taking actions in line with those commitments (see, for example,Climate Action Trackerfor quality coverage). We see this—what the UN Principles for Responsible Investment (UN PRI) describes as an “Inevitable Policy Response”—as a key transition risk to focus on. Policy changes can be both relatively sudden and of a magnitude that can significantly impact economies and markets, as illustrated by the economic shutdowns and shift to MP3 in response to COVID.

While transitioning to a low-carbon economy will require changes along many dimensions, a critical component is that economic players will need to make choices to shift from fossil fuels to greener sources of energy. This could happen because fossilfuels become more expensive, becausegreener alternatives become cheaper, or both.

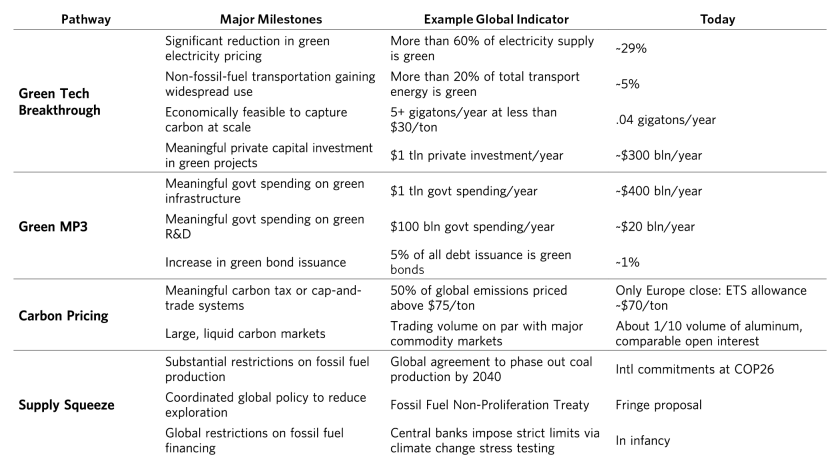

There are countless ways this shift could occur, but we see four primary mechanisms that would accelerate a green economic transition. Any combination of these is plausible. A “Goldilocks” outcome is a pathway that balances these, transitioning the global economy to lower carbon emissions without creating meaningful adverse economic conditions:

- Green Tech Breakthrough: An investment boom and step change in technology rapidly changes the trade-off faced by various entities today in favor of greener technologies. This increases productivity, likely stimulates meaningful private sector investment, and results in a growth boom that is likely disinflationary over time.

- Green MP3: Governments borrow/print and spend directly on green initiatives. This lowers the cost of renewable energy, accelerating the transition. Rising direct government spending is likely to exert upward pressure on both growth and inflation.

- Carbon Pricing: A meaningful ramp up in mandatory carbon pricing that raises the cost of emitting greenhouse gases. This is by its nature inflationary—as the mechanism through which it operates is increasing the costs of today’s activities in order to discourage them. The growth impact depends on who bears the tax burden and how the revenue is spent.

- Supply Squeeze: Limits on the supply of carbon-intensive energy (e.g., quotas on fossil fuel exploration, limits on financing to fossil fuel companies) force entities to reduce fossil fuel consumption. Energy shortages are likely to slow economic growth (as some activity is not replaced with greener alternatives). The first-order impact is inherently inflationary, as a supply squeeze leads to increases in energy prices; the second-order impacts of the slowdown in the economy are deflationary.

Below, we sketch out some of the major milestones on these pathways and take stock of where we are today.

Stress Testing the Impact of a More Rapid Climate Transition

To move from a particular transition driver to asset returns, we map how each of the major transition mechanisms would affect assets through a combination of macro conditions and climate-specific impacts. For example, a carbon tax that is passed through the supply chain to consumers will flow through to higher inflation much like any other tax, which will affect all assets. The specific nature of a carbon tax will also create shifts in consumption that create winners (e.g., green tech) and losers (e.g., fossil fuel companies). Every asset has different sensitivities to each of these drivers.

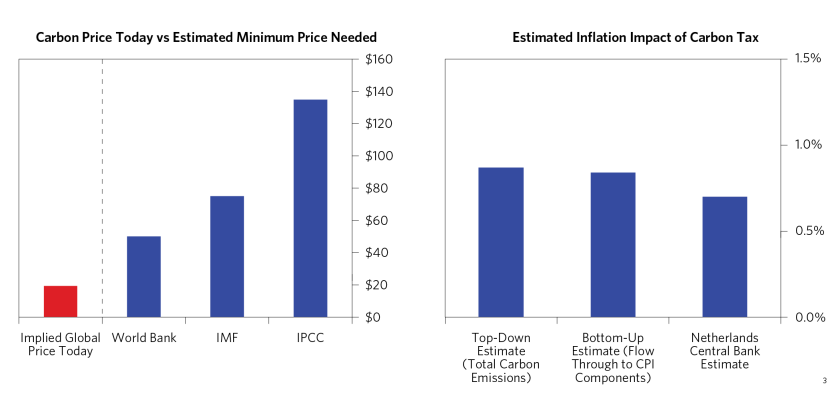

For example, for Carbon Pricing, we looked at what global carbon price might be required for a transition relative to prices today and penciled out how such a scenario would flow through to inflation—by comparing the total dollar value of carbon created, the likely pass-through to consumer prices for each component of CPI, and policy-maker studies.

3For specific attribution, see “Important Disclosures” at the end of this document.

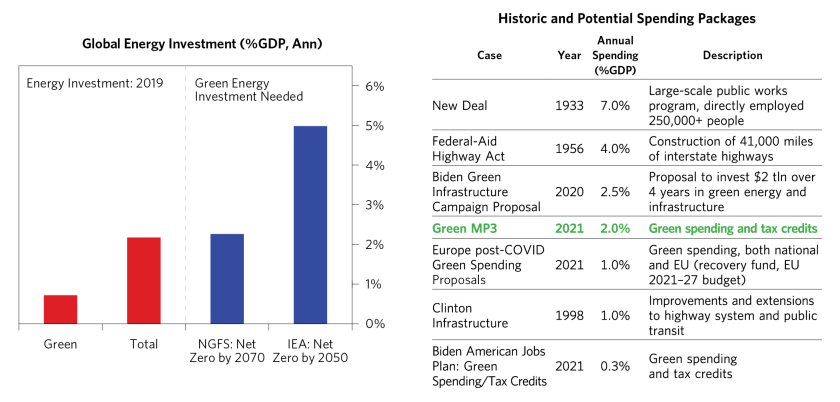

For Green MP3, we looked at large packages of green infrastructure that have been proposed and flowed these through our understanding of how government spending of various forms impacts the economy. Below, we show current total and green energy investment relative to estimates of the (large) amount needed under various low-carbon transition scenarios, and how a meaningful public green spending program would fit in the context of historical and proposed spending packages.

Each of the four transition mechanisms has very different macro impacts, and therefore different impacts on financial assets.Equities, for example, will tend to do better in periods of rising growth and in periods of falling inflation, so they would do best in the case of a green tech breakthrough that allows for cheaper and more reliable green technologies to be utilized.

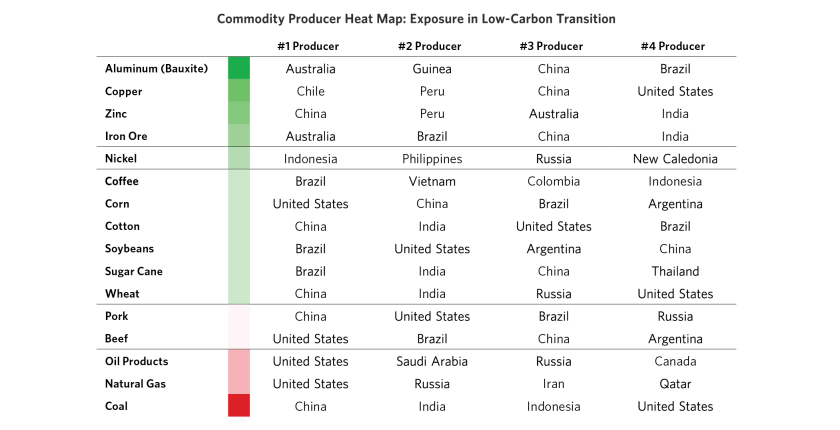

Beyond the macro effects described above, any successful transition will also create relative winners (e.g., green industry) and losers (e.g., carbon-intensive industry).For example, the transition will flow through to impact the supply and demand for the most relevant commodities and, in turn, the countries and companies most exposed to those commodities. If a transition is successful, fossil fuels will be used less while commodities that are inputs to green technologies will be more widely utilized. We have explored some of these potential winners and losers in previous researchregarding the sensitivities of commodities such asoil, coal, and industrial metals, among other markets.

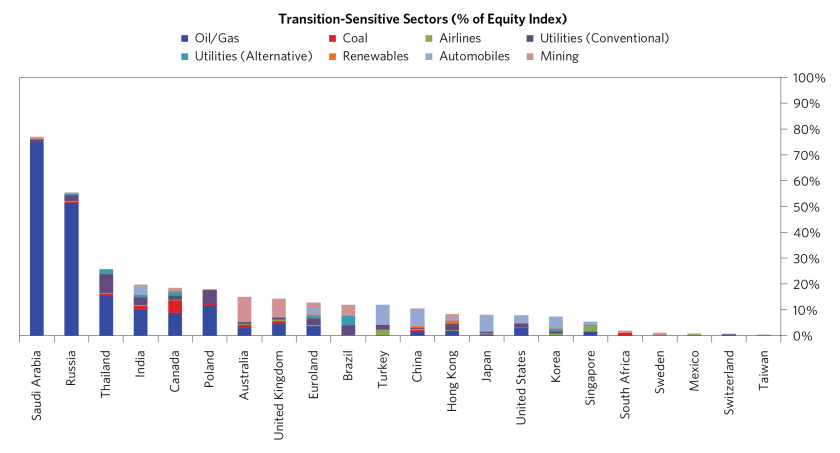

For most investors, the biggest source of portfolio risk is likely to be the macro implications of a faster climate transition.As shown above, the major asset classes would perform differently under different transition mechanisms, and this is the predominant risk. A lot of climate research focuses on which equity sectors are most likely to be impacted by a climate transition (e.g., oil and gas, utilities, transportation). These sectors, which are especially sensitive to any transition pathway, make up a small minority of most equity indices.

Pulling together the macro and the climate-specific effects, we sketch preliminary expected return impacts for portfolios under our faster-than-expected transition scenarios.There is a wide range of outcomes, driven largely by the variable macro outcomes. Any combination of these transition mechanisms is plausible; a “Goldilocks” outcome is a pathway that balances these mechanisms, transitioning the global economy to lower carbon emissions without creating meaningful adverse economic conditions.

4Estimated transition scenario impacts on the US Traditional Portfolio are based on Bridgewater analysis and are not guaranteed. Please see “Important Disclosures” for more information on the US Traditional Portfolio.

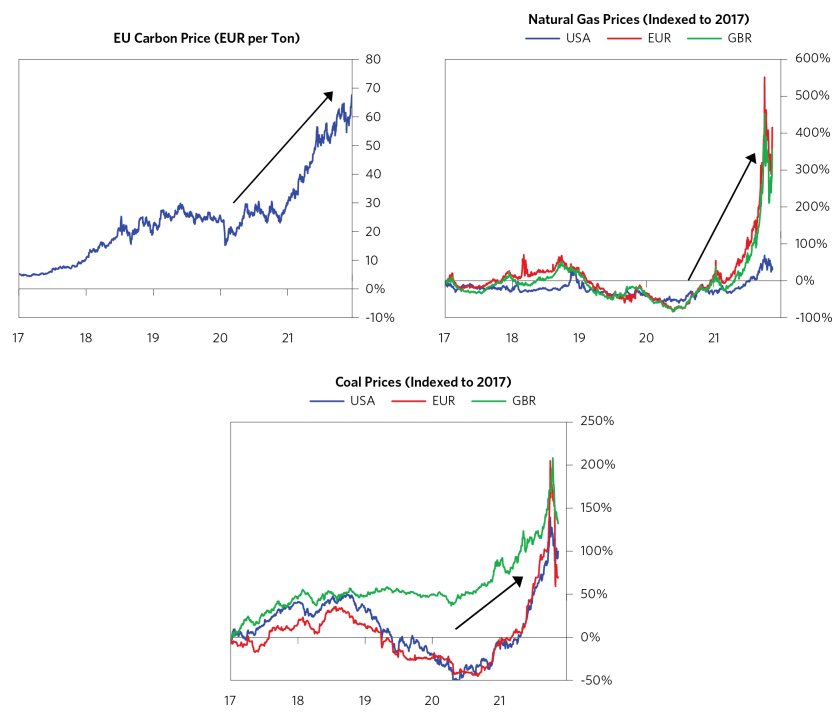

Thus far, the transition has been inflationary.We are already seeing (1) steps to price carbon, where carbon markets are developing globally, with Europe leading the way; (2) squeezing supply for the “dirtiest” energy sources by reducing capex for fossil fuels such as coal andoil; and (3) government MP3 policy (including green initiatives) increasing demand in an already hot economy. This early direction, indicated by the charts below, is particularly relevant because inflation is a meaningful risk for institutional investors. We will be making these transition scenarios available so readers can explore the portfolio impacts and the assumptions underlying each of these pathways on their specific asset allocation.

Appendix: Processing COP26 Relative to Our Climate Pathways

COP26 in Glasgow highlighted the growing political momentum around climate action, with nearly all countries in attendance and a substantial global public focus. The summit focused on continuing to aim for a 1.5°C target (i.e., limiting temperature rise to 1.5°C above preindustrial levels, an important benchmark for limiting the worst damages from climate change, requiring reducing emissions by ~45% by 2030).

While there was some progress at the summit—mostly around agreements that lay the groundwork for a transition—there are still very substantial gaps to get to arealistic trajectory to meet the 2030 emissions targets(i.e., more climate action is probably ahead of us). While there are very important technical, language, and country-specific nuances (see here for a verydetailed summary), we process in broad strokes the major outcomes from COP26 against our climate pathways.

Supply Squeeze

- Phasedown of coal and phaseout of fossil fuel subsidies: This was the first explicit mention of moving away from fossil fuels in a COP document, though the language was softened to “phasing down” rather than “phasing out” coal power after a last-minute push by India. The Glasgow Climate Pact also called for the “phase-out of inefficient fossil fuel subsidies,” signaling a potential reduction in support for fossil fuel producers.

- Reducing fossil fuel financing: 39 countries and financial institutions agreed to end new direct public support for the international unabated fossil fuel energy sector by the end of 2022. Signatories include the US, the UK, Canada, and Germany, as well as the European Investment Bank and the East African Development Bank.

Carbon Pricing

- Regulation of the international carbon market: While it attracted fewer headlines, there was an important agreement to lay the groundwork for global carbon markets, regarding rules from nearly 200 governments on international carbon credit markets, including specifying the standards for UN-certified carbon credits. This agreement—Article 6—has been largely held up since the Paris Agreement in 2015 and will enable separate trading schemes (e.g., Europe, China, California) to connect with each other and create a more international market.

Green Tech Breakthrough

- “Breakthrough Agenda”: Over 40 countries (representing 70% of global GDP) agreed to accelerate the development and deployment of clean technologies and sustainable solutions through mobilizing both public and private finance. Targets include green power, vehicles, steel, and hydrogen.

Green MP3

- We did not see major concrete government spending plans come out of COP26.

This research paper is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, Bridgewater’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned.

Bridgewater research utilizes data and information from public, private and internal sources, including data from actual Bridgewater trades. Sources include, the Australian Bureau of Statistics, Bloomberg Finance L.P., Capital Economics, CBRE, Inc., CEIC Data Company Ltd., Clarus Financial Technology, Conference Board of Canada, Consensus Economics Inc., Corelogic, Inc., CoStar Realty Information, Inc., CreditSights, Inc., Credit Market Analysis Ltd., Dealogic LLC, DTCC Data Repository (U.S.), LLC, Ecoanalitica, Energy Aspects, EPFR Global, Eurasia Group Ltd., European Money Markets Institute – EMMI, Evercore, Factset Research Systems, Inc., The Financial Times Limited, GaveKal Research Ltd., Global Financial Data, Inc., Harvard Business Review, Haver Analytics, Inc., The Investment Funds Institute of Canada, ICE Data Derivatives UK Limited, IHS Markit, Impact-Cubed, Institutional Shareholder Services, Informa (EPFR), Investment Company Institute, International Energy Agency (IEA), Investment Management Association, JP Morgan, Lipper Financial, Mergent, Inc., Metals Focus Ltd, Moody’s Analytics, Inc., MSCI, Inc., National Bureau of Economic Research, Organisation for Economic Cooperation and Development (OCED), Pensions & Investments Research Center, Qontigo GmbH, Quandl, Refinitiv RP Data Ltd, Rystad Energy, Inc., S&P Global Market Intelligence Inc., Sentix GmbH, Spears & Associates, Inc., State Street Bank and Trust Company, Sustainalytics, Totem Macro, United Nations, US Department of Commerce, Verisk-Maplecroft, Vigeo-Eiris (V.E), Wind Information(HK) Company, Wood Mackenzie Limited, World Bureau of Metal Statistics, and World Economic Forum. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues.