Lord Abbett investment leaders examine important issues that could influence the global investment environment in the second half of 2022.

Our panelists focused on key challenges facing the global investment and economic landscape. While most global economies are benefiting from strong consumer demand, the war in Ukraine and lockdowns in China are exerting additional strains on the global energy and supply chain complexes. Central banks are tightening monetary policy in response to surging inflation, raising concern over prospects for economic growth. These challenges contributed to the substantial financial-market volatility in the first half of 2022 and raise questions about how investors may potentially adapt to market uncertainties arising from the unprecedented macro environment.

“Higher market uncertainty will persist until the underlying inflation situation is resolved.”

Will Inflation Expectations Change?

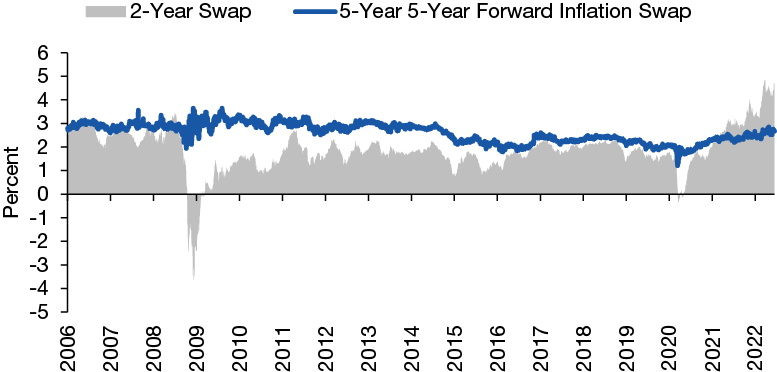

One of the important questions is: How long can inflation remain above 2% without causing the longer-term inflation expectations of households, companies, and investors to rise to a level that is inconsistent with an eventual return to the Fed’s (U.S. Federal Reserve) target. This is equivalent to asking how long can the Fed mainain its “credibility” in an environment where inflation persistently exceeds its target? For now, long-term inflation expectations, indicated by the market’s pricing of the five-year inflation rate five years from now, are consistent with a return to a 2% target rate (see Figure 1), while short-term inflation expectations have risen. However, if inflation remains high for an extended period, as the Fed tightens monetary policy to contain it, those relationships may start to change, which could potentially introduce more uncertainty for economic growth.

Figure 1. Long-Term Inflation Expectations Consistent with Fed’s Target for Now

Assessing U.S. Recession Risks

Supply constraints that arose due to the pandemic have been a significant contributor to high inflation. A tightening of monetary policy that reduces aggregate demand enough to cause a recession would also delay the recovery of aggregate supply over the medium term. We believe the Fed is aware that a recession may not drive inflation durably below the 2% target since the demand recovery that follows would quickly run into those same supply constraints. We think higher market uncertainty will persist until the underlying inflation situation is resolved; monetary policy is the wrong tool for easing supply constraints and volatility will remain elevated until investors conclude that fundamentals have evolved enough to make the Fed’s policy tools once again fit for purpose.

There are also factors that may contribute to sustained, slower growth during this period of Fed tightening. Consumers’ financial health remains sound. Although higher energy prices have put downward pressure on measures of consumer sentiment, U.S. retail spending data has been robust. Labor markets are historically tight, and jobs are plentiful, while overall corporate earnings results are favorable. And finally, we think a transitional period of elevated capital spending to adapt to a post-COVID-19 environment, such as optimizing supply chains and adapting office and factory space, will be supportive to growth. But if the real economy continues growing strongly enough to keep the labor market tight and corporate earnings strong, it may conflict with the Fed’s need to maintain tight financial conditions in order to keep inflation low enough to retain its credibility.

Evaluating Global Growth and Inflation Concerns

Labor markets in Europe were not severely dislocated because pandemic policies generally supported people while they remained in their jobs. However, food and energy price shocks due to the war in Ukraine are contributing to high inflation readings, and recent consumer sentiment reports from Eurostat remain at depressed levels. However, Eurostat surveys of expected future industrial production over the next three months have improved. Overall, we think the war in Ukraine will not tip the region into a recession, although the crisis will continue to keep uncertainty elevated.

The strength or weakness of a full reopening in China remains unknown until they have either successfully subdued the COVID-19 virus or adapted public health measures within their zero-COVID policy that allow a complete reopening. Supply-chain disruptions, global inflation, and global growth risks associated with China’s current approach to fighting COVID-19 may continue until those conditions change.

“Major central bank policies will vary depending on inflation and economic growth conditions and differing monetary policy responses will foster global growth uncertainty, as well as potential opportunities.”

Central Banks Face Varying Macroeconomic Conditions

The war in Ukraine and the supply-chain issues relating to lockdowns in China are exacerbating global inflation. These geopolitical events represent global commonalities impacting headline inflation measures across countries.

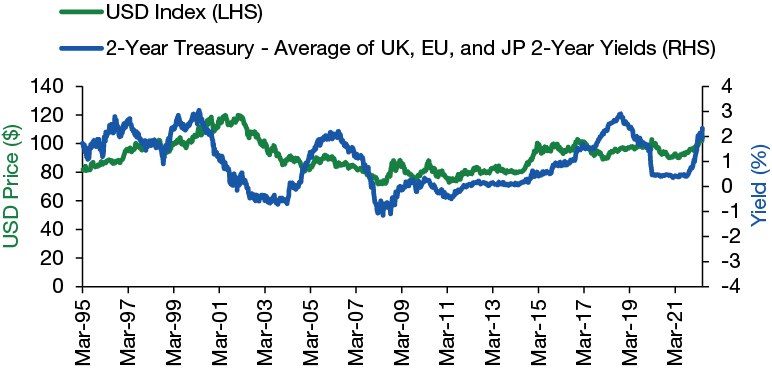

However, underlying inflationary dynamics and the persistence of those forces differ among countries. In the U.S., for example, core inflation measures are high, while Japan only recently reported positive core inflation rates in April and May—the first positive readings since January 2021. As a result, the Federal Reserve is embarking on a significant tightening of monetary policy while the Bank of Japan continues to ease. While most other major central banks are removing accommodation to combat inflation, the pace of tightening will vary depending on underlying inflation and economic growth conditions. Differing monetary policy responses will foster global growth uncertainty, as well as create potential opportunities.

Figure 2. Increasing Interest-Rate Volatility and the Rise in the USD

“EM central banks have improved the proactive deployment of monetary policy tools, bolstering the financial resilience of EM economies over the last decade.”

Geopolitical Tensions Add to the Complexity of Investing in Emerging Markets

Many EM central banks acted swiftly to tighten monetary policy when inflation began to rise in 2021. Those prudent policy decisions were in response to higher food and energy prices, which are a much larger share of consumers’ expenditures in EM countries. EM rate increases also supported currency valuations at a time when DM central banks were announcing potential plans to raise rates in the months ahead. Spreads on EM fixed income remained relatively stable in 2021, after rapidly compressing following the COVID-19 pandemic.

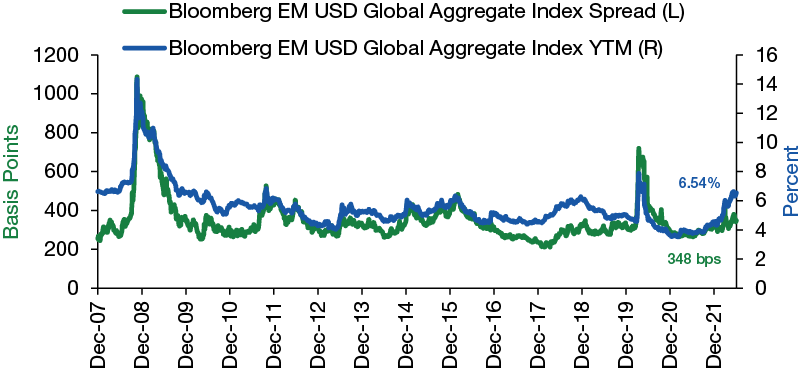

Substantial volatility returned in 2022 following Russia’s invasion of Ukraine, lockdowns in China, and rate increases in DM countries (see Figure 3). EM fixed-income markets, already pressured by inflation and rising rates, received an added blow from commodity price shocks and supply-chain issues that exacerbated the inflation conditions EM central banks were striving to contain. The elevated uncertainty in inflation and economic-growth risks across the EM landscape caused a substantial sell-off in EM fixed-income markets in the first half of 2022.

Figure 3. EM Fixed-Income Yields and Spreads Spike in 2022

Compared to previous episodes, such as the COVID-19 pandemic and global financial crisis, we think recent volatility and the disparate effects of the crisis in Ukraine on EM regions may provide selective opportunities at attractive yields. The impact from the conflict in Europe affects EM countries unevenly, which adds to the complex and meticulous research that must be applied to investing in EM markets during times of uncertainty.

Although we believe inflation and rate risk will potentially lead to volatility in the months ahead, EM central banks have established credibility when managing monetary policy rates and their effect on inflation and have improved the proactive deployment of policy tools, bolstering the financial resilience of EM economies over the last decade.

Our macroeconomic outlook for the EM fixed-income markets overall remains constructive, but we are very vigilant about the potential future impacts from a prolonged conflict in Ukraine, COVID-19 outcomes in China, and the direction of rate hikes in DMs. Carefully differentiating which securities, countries, and regions to emphasize outside of the benchmark is critical in an uncertain investment environment.

“Our base case remains: inflation will moderate, and economic growth will persist, albeit at low levels.”

A Slowing Economy and What it May Mean for Credit

Fixed-income investors faced a very challenging macroeconomic environment in the first half of 2022. Soaring inflation readings and the Fed’s pivot to a more restrictive stance induced a sell-off paced by concerns over how quickly and aggressively the Fed would need to act to subdue inflation. Longer-duration bonds with more interest-rate sensitivity felt the brunt of the impact, but short-maturity credit also declined on rate concerns.

We have entered this cycle of Fed tightening with relatively strong corporate balance sheets and a consumer base with significant liquidity built through COVID-driven fiscal support, housing wealth, and a continued tight labor market. And while this is supportive of economic momentum and growth, the potential for inflation persistence and increased Fed hawkishness mean that we must be wary of the increased probabilities of slowing economic growth and recession.

Most corporate high yield bond issuers entered 2022 with attractive credit metrics. Leverage ratios moved lower in the first quarter of 2022 following considerable declines in the previous three quarters, according to J.P. Morgan data. The credit profile of the high yield market also suggests a relatively benign default environment for the rest of 2022, which we believe is appropriate given the lack of a near-term maturity wall and overall corporate and consumer health. However, as long as uncertainty remains in the marketplace, performance for more levered companies may remain quite volatile.

The backdrop for bank loans represents a similar risk profile: the asset class offered the potential for rising income as floating-rate coupons adjusted to reflect rising benchmark rates, which was a positive technical factor which benefited the sector early in the year—limited interest-rate sensitivity in a rising-rate environment. But as expectations of rate hikes change and become larger, the bank loan market has suffered from increased expectation of recession and attendant decline in credit fundamentals.

Credit risk valuations have widened, but in our view are not pricing in a worst-case scenario or hard landing. Given the many uncertainties around inflation, rates, and Fed policy, the near-term path for credit is also uncertain. While investors are likely to recoup any credit investments over time, given the still-benign outlook for defaults even in a hard landing scenario, we favor credit risk in certain higher-quality areas, where we believe valuations are more favorable. Current examples of these opportunities include investment-grade corporate debt and AAA-rated asset-backed securities, which currently offer high levels of liquidity and are generally better protected from market volatility.

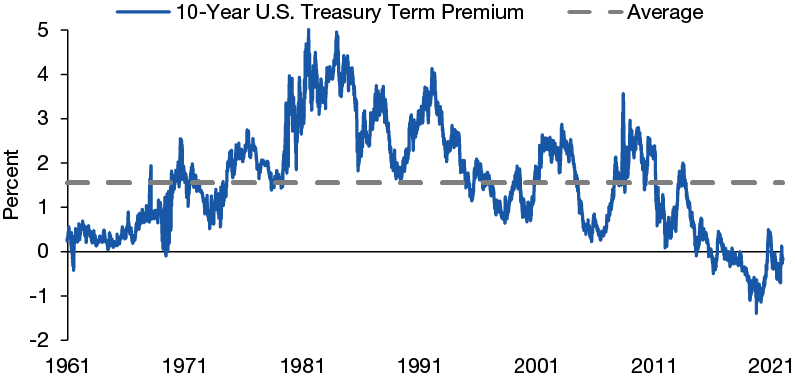

In addition, term premium–the amount investors expect to be compensated for lending for longer periods–remains far from typical levels. A reversal in term premium, as investors demand higher yields to adjust for inflation risk on longer-maturity bonds, may potentially result in a continued environment of challenging absolute returns for longer-duration assets (see Figure 4.)

Figure 4. Term Premium Still a Long Way from Typical and Potentially Set to Increase

“We remain bullish on the long-term outlook for equities because the technology revolution is ever more powerful with each passing year.”

Weathering Volatility and Preparing for Opportunity

The inflationary environment has ushered in quantitative tightening and brought about a deep bear market for innovation growth stocks. The Russian invasion of Ukraine has exacerbated inflation through higher food and energy prices. Some additional hot inflation numbers may hit this summer, suggesting that the Fed may be a challenging force for equities. We respect the main rule—“don’t fight the Fed.” Accordingly, we continue to be positioned more defensively than normal.

Technically, we are seeing signs of the bottoming process, such as poor investor sentiment, elevated VIX Index readings and put/call ratios, and poor market breadth. This suggests that a rally within the bear market is likely, in our view. To become more offensive, we would need to see an increase in the number of snapbacks (stocks moving up through 150-day moving averages) and uptrends. Current market breadth, as measured by the percent of stocks trading above their 150-day moving averages, has been hovering above 20%, a level that is so bad, it might be good. This fell as low as 4% in March of 2020 though, so we are not in the washout zone yet.

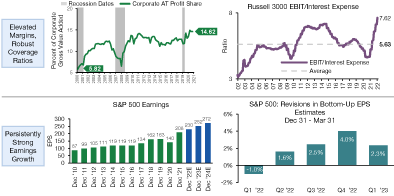

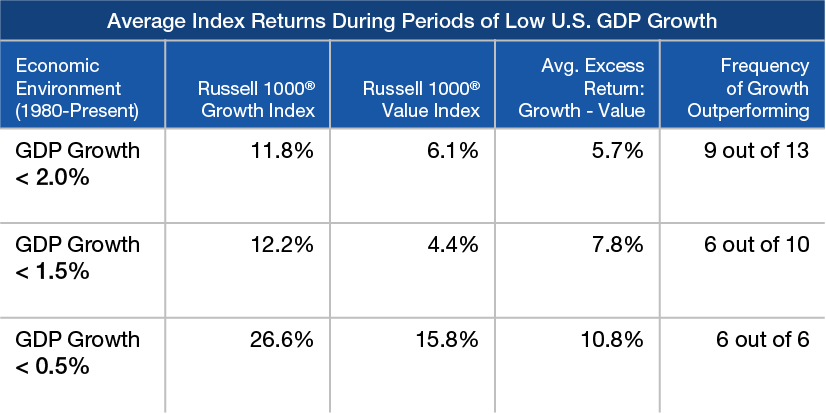

Our view is that the powerful secular forces that kept inflation low before the pandemic, such as demographics, high debt levels, and the technology revolution, will reassert themselves at some point. Along with the onset of monetary policy tightening and the waning of fiscal stimulus, we believe these will cause growth and inflation to decelerate significantly, over the intermediate term, from very high levels. Until that happens, we think equity markets will continue to face potentially aggressive Fed action. In that environment, however, overall healthy corporate fundamentals should provide support as economic growth slows. Margins and interest coverage ratios are high; earnings growth estimates are strong; and revisions in EPS (earnings-per-share) estimates are positive (see Figure 5).

Figure 5. Corporations in a Healthy Position to Weather Economic Headwinds

Figure 6. Growth Equities Historically Have Performed Well in Periods of Slower U.S. Economic Growth

We remain bullish on the long-term outlook for equities because the technology revolution is ever more powerful with each passing year, providing a supportive backdrop for innovation in the Consumer, Communications, Healthcare, and Technology sectors in the decade ahead. We continue to see numerous attractive companies in these areas that are early in their life cycles with years of high growth to come.

As informações aqui contidas estão sendo fornecidas pela GAMA Investimentos (“Distribuidor”), na qualidade de distribuidora do site. O conteúdo deste documento [e informações neste site] contém informações proprietárias sobre LORD ABBETT e o Fundo. Nenhuma parte deste documento nem as informações proprietárias do LORD ABBETT ou DO Fundo aqui podem ser (i) copiadas, fotocopiadas ou duplicadas de qualquer forma por qualquer meio (ii) distribuídas sem o consentimento prévio por escrito do LORD ABBETT. Divulgações importantes estão incluídas ao longo deste documento e que devem ser utilizadas exclusivamente para fins de análise do LORD ABBETT e do Fundo. Este documento não pretende ser totalmente compreendido ou conter todas as informações que o destinatário possa desejar ao analisar o LORD ABBETT e o Fundo e/ou seus respectivos produtos gerenciados ou futuramente gerenciados. Este material não pode ser utilizado como base para qualquer decisão de investimento. O destinatário deve confiar exclusivamente nos documentos constitutivos de qualquer produto e em sua própria análise independente. Nem o LORD ABBETT nem o Fundo estão registrados ou licenciados no Brasil e o Fundo não está disponível para venda pública no Brasil. Embora a Gama e suas afiliadas acreditem que todas as informações aqui contidas sejam precisas, nenhuma delas faz qualquer declaração ou garantia quanto à conclusão ou necessidades dessas informações.

Essas informações podem conter declarações de previsões que envolvem riscos e incertezas; os resultados reais podem diferir materialmente de quaisquer expectativas, projeções ou previsões feitas ou inferidas em tais declarações de previsões. Portanto, os destinatários são advertidos a não depositar confiança indevida nessas declarações de previsões. As projeções e/ou valores futuros de investimentos não realizados dependerão, entre outros fatores, dos resultados operacionais futuros, do valor dos ativos e das condições de mercado no momento da alienação, restrições legais e contratuais à transferência que possam limitar a liquidez, quaisquer custos de transação e prazos e forma de venda, que podem diferir das premissas e circunstâncias em que se baseiam as perspectivas atuais, e muitas das quais são difíceis de prever. O desempenho passado não é indicativo de resultados futuros.