Link para o documento original : https://www.acadian-asset.com/viewpoints/acadians-approach-to-value-investing

November 2019

- Although value is widely discussed as if it were a one-dimensional and well-defined concept, it is implemented in myriad ways that generate materially different investment outcomes.

- Acadian’s approach to value investing reflects three key principles: 1) the value premium arises from investors’ behavioral mistakes, 2) value should be implemented within a multifactor process, and 3) value implementations should be nuanced and evolving.

- While we believe that refined approaches will improve long-term investment outcomes relative to rudimentary implementations, investors should expect them to episodically underperform.

Value investing is deceptively simple, although in practice it is implemented in myriad ways that generate materially different investment outcomes. Despite this, media, practitioner, and academic discussions routinely refer to “value” as if it were a one-dimensional, singular phenomenon. Such treatments fail to recognize that value encompasses multifaceted economic concepts, and that different implementations may reflect divergent beliefs as to what the value premium represents and the best way to harvest it.

The purpose of this note is to articulate the core tenets of Acadian’s approach to value investing. We believe that 1) the value premium arises from investors’ behavioral mistakes, 2) value should be implemented through a multifactor investment process, and 3) value signals should be nuanced and evolving, benefitting from ongoing research. We explain and motivate key design choices related to the selection, construction, and combination of predictive signals that we believe benefit performance over the long term. We discuss why investors, nevertheless, should expect our approach to episodically underperform rudimentary value implementations.

A Refined, Multifactor Approach to Value

Acadian’s approach to value reflects three guiding principles:

PRINCIPLE #1: The value premium arises from investors’ behavioral mistakes

We believe that the value premium represents alpha, i.e., market inefficiencies, rather than a risk premium. Value-related mispricings derive from investors’ behavioral mistakes. Among them, investors are prone to over-extrapolate recent patterns in fundamentals owing to perceptual biases and errors in judgment, including recency bias and overconfidence. This behavioral perspective is consistent with long-term stagnation of value in the U.S. large-cap universe as well as superior efficacy in non-U.S. developed markets and EM. If the payoff to value represented a risk premium, then it’s not clear why we would see such relatively poor efficacy in the most transparent and liquid market segments.

The behavioral perspective has practical implications. First, since its inception, Acadian has oriented its investing activities to areas of the market where the information environment is poor and trading more difficult, conditions that are conducive to material and persistent pricing errors. That includes DM ex-U.S. and EM as well as smaller-cap and less liquid stocks.

Second, it sets an expectation that value investing will be an inherently uncomfortable exercise, arguably in times resembling the present. To capitalize on the behavioral mistakes of other investors necessarily implies disagreeing with views that they hold strongly enough to put money behind.

Third, it implies that value will experience episodic drawdowns and payoffs. While we expect to capitalize on a steady stream of stock-specific mispricings, the market also experiences bouts of “thematic inefficiency,” such as the TMT bubble, that present rich opportunity sets and contribute materially to value’s long-term performance. Such episodes are inherently difficult to predict and to time; they develop in part because investors find it so difficult to recognize them even as they are happening. Value investors should expect pain as such conditions materialize, possibly for extended periods and even from refined and well risk-controlled specifications.

PRINCIPLE #2: Value should be implemented within a multifactor process

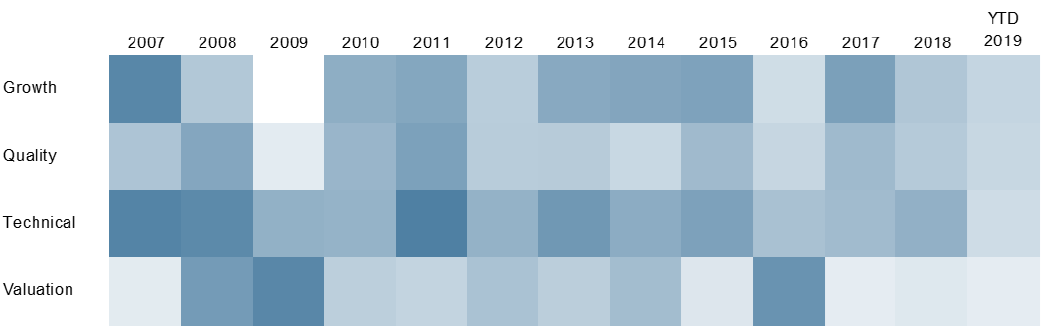

The most familiar justification for a multifactor approach is that it diversifies sources of alpha. All factor groups in our stock forecasting model, not only value but also technical, quality, and growth, contribute to its long-run efficacy. No factor is consistently superior, as evidenced by the relative performance heatmap in Figure 1, and each factor, not just value, will experience drawdowns, some severe and protracted.

The multifactor approach offers several additional potential advantages. First, it affords more precise exposure to desired mispricings. Rudimentary value formulations are noisy. Simply because a stock has a high B/P ratio does not imply that it is an attractive investment opportunity; the market may be severely but appropriately (or even insufficiently) discounting the company’s ability to generate earnings from its assets, i.e., its fundamentals “look cheap for a reason.”

As a result, portfolios formed solely on the basis of B/P will contain such impurities, i.e., value traps, along with genuinely attractive value investing targets, e.g., stocks where the market has over-extrapolated prior deterioration in fundamentals. Due to their imprecise construction, such portfolios are likely to exhibit substantial and time varying exposures to known risk factors that may obscure the mispricings that we believe give rise to the value premium, diluting performance and confusing its interpretation.

Through a multifactor implementation, we improve the signal-to-noise ratio by interacting value with information about other characteristics, such as quality. Our quality metrics include reliability of earnings growth and management behavior. Bringing such information to bear helps us to distinguish genuinely mispriced fundamentals from stocks that are cheap for good reason.

Figure 1: Relative Performance of Acadian Factor Group

Darker blue represents higher relative returns on hypothetical long-short quintile portfolios, Acadian DM + EM universe of securities.

Chart is based on returns of hypothetical long-short portfolios formed by ranking stocks on the basis of each Acadian proprietary factor group. Darker blue implies higher return relative to returns pooled across all factor groups over the full sample period. Source: Acadian. For illustrative purposes only. The chart represents an educational illustrative exhibit and does not represent investment returns generated by actual trading or actual portfolios. The results do not reflect trading costs, borrow costs, and other implementation frictions and do not reflect advisory fees or their potential impact. For these and other reasons, they do not represent the returns of an investible strategy. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

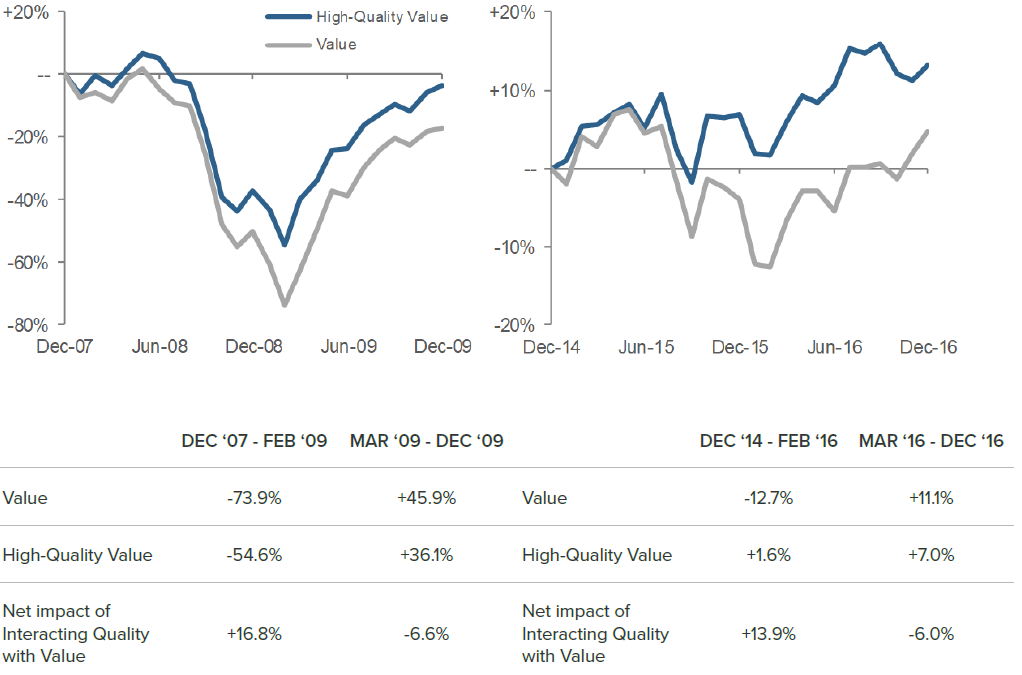

Figure 2 illustrates a performance benefit of interacting value and quality attributes during two episodes, the GFC and the 2H 2015 sell-off. It shows that high-quality value may have attenuated the drawdown and provided overall higher returns through the cycle. Nevertheless, pure value would have outperformed in the rebound, having suffered larger losses to begin with. In summary, while we believe the multifactor implementation improves investment outcomes over the long-term, investors should expect to episodically underperform simple value implementations, “junk” rallies representing a classic example.

A second benefit of the multifactor implementation is more efficient deployment of capital. Even if a stock is underpriced, it might soon become even cheaper if sentiment continues to deteriorate. The circumstance is commonplace in value investing, because poor momentum directly affects the ‘P’ in valuation ratios. Value and momentum characteristics tend to be negatively correlated as a result, and pure value strategies offered by traditional managers and smart beta purveyors often display negative momentum characteristics.

While momentum-unaware pure value strategies are implicitly willing to wait out the market’s repricing of fundamentals, our process is designed to tilt towards value candidates where improving sentiment suggests a relatively near-term repricing of fundamentals and to tilt away from those for which deteriorating sentiment suggests the discount might persist or even expand.

Finally, while quality, momentum, and growth signals influence our implementation of value, the reverse is true as well. Specifically, we employ value in our multifactor forecasting model to help ensure that we don’t pay too much for exposure to attractive quality, technical, and growth characteristics via both implicit and explicit mechanisms.

Figure 2: Benefit of Interacting Value with Quality – Selected Market Drawdowns

Cumulative (compounded) returns of hypothetical long-only factor portfolios, Acadian DM universe of securities.

Hypothetical long-only Value portfolio formed from top quintile stocks as ranked on the basis of Acadian proprietary value factor. Hypothetical long-only High-Quality Value portfolio formed from intersection of the Value portfolio with a similarly constructed long-only portfolio of stocks as ranked on the basis of Acadian proprietary quality factor. Source: Acadian. For illustrative purposes only. The charts represent educational exhibits and do not represent investment returns generated by actual trading or actual portfolios. Hypothetical returns do not reflect trading costs, borrow costs, and other implementation frictions and do not reflect advisory fees or their potential impact. For these and other reasons, they do not represent the returns of an investible strategy. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

PRINCIPLE #3: Value implementations should be nuanced and evolving

Value investing is an empirical exercise where the objective is to identify companies whose market valuations look aberrant relative to fundamental measures of their equity’s worth. Systematic value approaches typically employ some form of cross-sectional analysis to identify attractive investing candidates. To do so with precision requires two things: economically meaningful fundamental metrics and their comparison within appropriate and internally consistent sets of stocks.

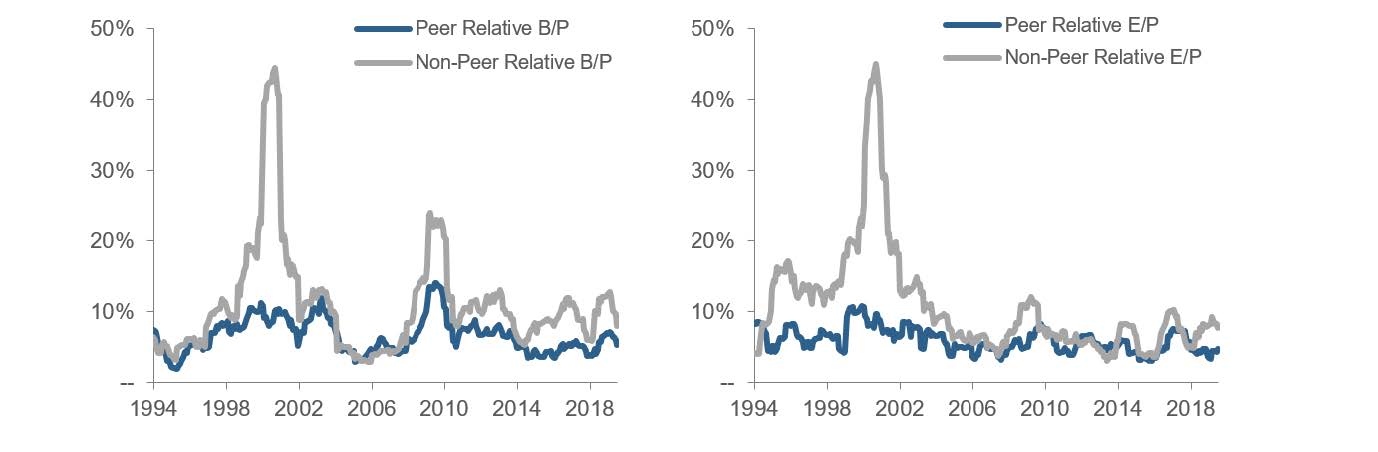

Simple B/P and E/P constructions fail to meet these requirements. They employ noisy valuation metrics and evaluate them based on inappropriate comparisons. One commonplace design flaw is a failure to distinguish between peer-relative and sector- or country-level valuation differences even though empirical studies suggest that the bulk of value’s return premium is derived from stock selection rather than allocation.1 As we’ve documented in prior research, failure to control for allocation effects can introduce substantial variation into sector composition, risk characteristics, and performance.2 Figure 3 shows that peer-relative constructions have the potential to produce substantially lower returns volatility in the context of both B/P and E/P value portfolios.

A second design flaw in the construction of valuation metrics is a failure to adjust for differences in the economics that underlie financial statement data. As a topical example, technology companies often exhibit deflated book values because they generate substantial intangible assets through R&D, which is expensed under GAAP accounting.3 As a result, P/B based implementations that aren’t industry (and perhaps geography) aware will tend to underweight companies and sectors with high levels of intangibles.

Our process deals with such deficiencies in several ways. Employing peer-relative valuation metrics helps to adjust for structural and episodic variation in financial statement data across industries and geographies that confounds comparisons across stocks and obscure mispricings. We also adjust and augment raw valuation-related accounting items. For example, our process incorporates information about R&D expenses and brand value, which isn’t reflected in book value, as well as the distinction between retained earnings and contributed capital, which research suggests is relevant to the efficacy of income-based valuation metrics. Further adjustments are an important focus of our research agenda, to ensure that valuation-based elements of our alpha forecast keep pace with changes in industry structures, management practices, and financial reporting.

Figure 3: Volatility Reduction Benefits of Peer-Relative Value Formulations

Annualized rolling 12-month realized volatilities of long-short value-minus-glamour portfolios, Acadian U.S. universe of securities, Feb 1994 – Aug 2019.

Annualized rolling one-year volatilities of hypothetical long-short value-minus-glamour portfolios formed from top and bottom quintile stocks as ranked on the basis of B/P and E/P valuation ratios. Portfolios are market capitalization weighted and rebalanced monthly. Source: Acadian. For illustrative purposes only. The charts represent educational exhibits and do not represent investment returns generated by actual trading or actual portfolios. Hypothetical returns do not reflect trading costs, borrow costs, and other implementation frictions and do not reflect advisory fees or their potential impact. For these and other reasons, they do not represent the returns of an investible strategy. Hypothetical results are not indicative of actual future results. Every investment program has the opportunity for loss as well as profit.

Conclusion

In summary, the design enhancements embedded in Acadian’s implementation of value have strong motivations and we believe that they have the potential to benefit performance over the long term. Nevertheless, investors must be prepared to underperform rudimentary implementations under certain market conditions. Despite the refinements in our process, we have no expectation that it will unfailingly outperform the market. Isolating mispricings is enormously challenging, and we cannot filter out all value traps from portfolios nor completely immunize them against unintended risk exposures. As such, we, like all value investors, expect bouts of underperformance, some of the most painful of which are a natural and unavoidable consequence of value investing’s contrarian nature.

2 For example, see https://www.acadian-asset.com/viewpoints/values-intricacies-and-the-margin-of-safety,Acadian. August 2016.

3 For more information, see https://www.acadian-asset.com/viewpoints/the-evolution-of-value, Acadian. December 2018.

The value of investments may fall as well as rise and you may not get back your original investment. Past performance is not necessarily a guide to future performance or returns. Acadian has taken all reasonable care to ensure that the information contained in this material is accurate at the time of its distribution, no representation or warranty, express or implied, is made as to the accuracy, reliability or completeness of such information.

This material contains privileged and confidential information and is intended only for the recipient/s. Any distribution, reproduction or other use of this presentation by recipients is strictly prohibited. If you are not the intended recipient and this presentation has been sent or passed on to you in error, please contact us immediately. Confidentiality and privilege are not lost by this presentation having been sent or passed on to you in error.

Acadian’s quantitative investment process is supported by extensive proprietary computer code. Acadian’s researchers, software developers, and IT teams follow a structured design, development, testing, change control, and review processes during the development of its systems and the implementation within our investment process. These controls and their effectiveness are subject to regular internal reviews, at least annual independent review by our SOC1 auditor. However, despite these extensive controls it is possible that errors may occur in coding and within the investment process, as is the case with any complex software or data-driven model, and no guarantee or warranty can be provided that any quantitative investment model is completely free of errors. Any such errors could have a negative impact on investment results. We have in place control systems and processes which are intended to identify in a timely manner any such errors which would have a material impact on the investment process.

Acadian Asset Management LLC has wholly owned affiliates located in London, Singapore, and Sydney. Pursuant to the terms of service level agreements with each affiliate, employees of Acadian Asset Management LLC may provide certain services on behalf of each affiliate and employees of each affiliate may provide certain administrative services, including marketing and client service, on behalf of Acadian Asset Management LLC.

Acadian Asset Management LLC is registered as an investment adviser with the U.S. Securities and Exchange Commission. Registration of an investment adviser does not imply any level of skill or training.

Acadian Asset Management (Singapore) Pte Ltd, (Registration Number: 199902125D) is licensed by the Monetary Authority of Singapore.

Acadian Asset Management (Australia) Limited (ABN 41 114 200 127) is the holder of Australian financial services license number 291872 (“AFSL”). Under the terms of its AFSL, Acadian Asset Management (Australia) Limited is limited to providing the financial services under its license to wholesale clients only. This marketing material is not to be provided to retail clients.

Acadian Asset Management (UK) Limited is authorized and regulated by the Financial Conduct Authority (‘the FCA’) and is a limited liability company incorporated in England and Wales with company number 05644066. Acadian Asset Management (UK) Limited will only make this material available to Professional Clients and Eligible Counterparties as defined by the FCA under the Markets in Financial Instruments Directive.