Link para o artigo original: https://www.oaktreecapital.com/insights/insight-commentary/market-commentary/performing-credit-quarterly-2q2024-the-dual-economy

Armen Panossian

Armen Panossian

Head of Performing Credit and Portfolio Manager

Danielle Poli, CAIA

Danielle Poli, CAIA

Managing Director and Assistant Portfolio Manager

Performing Credit Quarterly 2Q2024: The Dual Economy

What does this mean for credit markets? This concentration of wealth has caused capital markets to be far more generous than would be expected in an elevated interest rate environment. As a result, many highly levered companies have been able to postpone potential problems by refinancing their debt.

But the mixed signals the Federal Reserve is receiving – e.g., booming financial markets, low but rising unemployment, and declining but still elevated inflation – make it unlikely that the central bank will cut interest rates aggressively in the near term. If interest rates stay well above their ten-year average for an extended period of time and pockets of the economy weaken, companies with unstable capital structures may find it increasingly challenging to keep kicking the can down the proverbial road. Thus, we believe credit investors should proceed with caution and avoid assuming that major concerns about corporate credit are all in the rearview mirror.

A Tale of Two Consumers

At a time when aggregate U.S. economic data is mostly positive and financial markets are booming, one might expect consumer confidence to be increasing. But this isn’t the case. Only one-third of consumers maintain a positive outlook on the U.S. economy, primarily due to concerns relating to the high cost of many essential goods.1 This figure is down roughly five percentage points since February. In the most recent University of Michigan survey, many consumers indicated that they plan to reduce spending on non-essential items, and over 75% stated that they’ve recently been buying smaller quantities of products or delaying large purchases, actions indicating worsening economic conditions.

This declining optimism shouldn’t be surprising given that the balance sheets of lower- and middle-income consumers have begun to deteriorate. Debt service as a percentage of disposable income reached the lowest level in decades in the first quarter of 2021, largely because many consumers used Covid-19 stimulus checks to pay down their debt. However, once stimulus checks stopped arriving, credit card debt began to creep back upward. By mid-2024, debt service as a percentage of disposable income was already back near its 2019 level.2

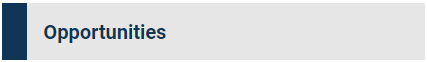

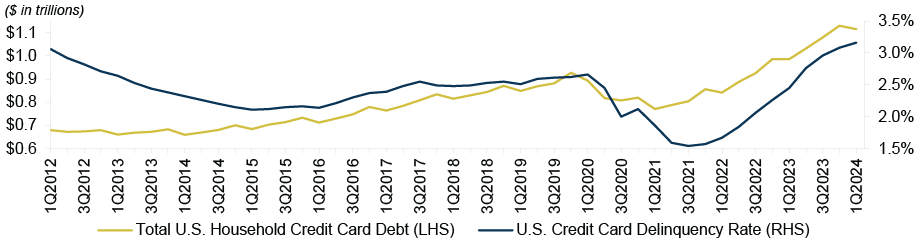

Credit card debt has risen to exceed $1 trillion,3 while credit card delinquencies have reached a level not seen since 2011. (See Figure 1.) At the same time, consumers are now saving less: the U.S. personal savings rate fell to 3.9% in May, less than half of the long-term average of 8.4% and well below the double-digit pandemic-era peaks.4

Figure 1: U.S. Credit Card Debt and Delinquencies Haven’t Been This High in Over a Decade

Source: Federal Reserve Bank of New York, as of March 2024

These mounting pressures are also reflected in sales at some retail businesses that cater to the middle and lower-middle classes. For example, in 1Q2024, midmarket chain Kohl’s significantly underperformed earnings expectations, and management indicated that pressure on the company’s middle-income consumer base was among the largest drivers of this underperformance.

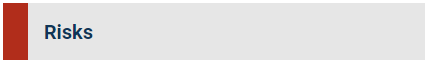

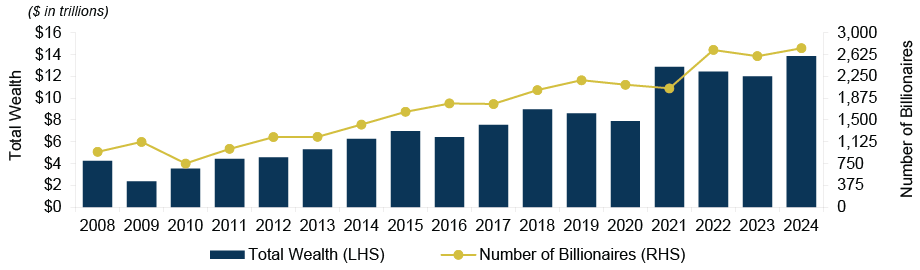

Figure 2: There Are More Billionaires Than Ever

Source: Forbes, as of April 2024

In a related trend, large U.S. companies are enjoying significant liquidity, with over $4 trillion of cash reserves in aggregate.6(See Figure 3.) Technology giants such as Apple, Alphabet, and Microsoft are particularly prominent within this group; the three collectively hold more than 15% of the total cash on the books of companies in the S&P 500 Index.7 These excess cash holdings are enabling companies to buy back short-dated debt and increase share buybacks. In 2025, the latter are expected to exceed $1 trillion in the U.S. for the first time ever.8 If this increase in share buybacks materializes, it could be a meaningful catalyst for further equity market appreciation, which will only make economic bifurcation in the U.S. more pronounced.

Figure 3: U.S. Corporates Are Sitting on Large Cash Piles

Source: Bloomberg, as of March 2024

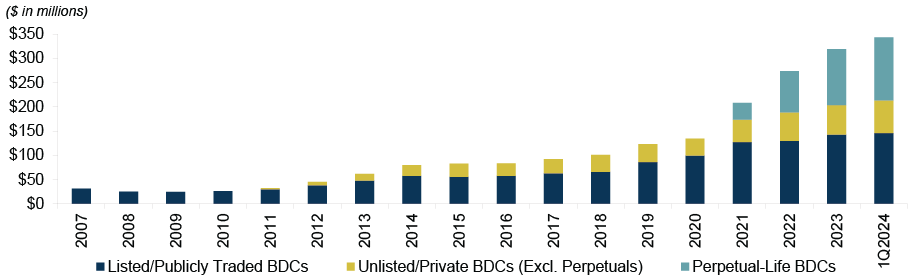

The Wall of Money

This significant concentration of wealth means that there is a surplus of capital in need of allocation. Consequently, wealthy individuals around the global have sought new investment opportunities in a variety of asset classes, including market segments once available only to the biggest institutional investors. For example, individual investors have increasingly been gaining access to private markets through business development companies (i.e., publicly registered funds that lend to small and middle-market businesses). BDCs’ assets under management grew by more than 20% year-over-year in 1Q2024 to eclipse $340 billion,9 and this massive increase in AUM was largely driven by the expansion of BDCs’ investor base from institutional to retail investors. Wealthy investors have also been allocating more capital to retail investment funds that offer exposure to private equity. Importantly, these trends aren’t likely to reverse any time soon: over 70% of wealth advisors in the U.S. anticipate increasing their clients’ allocation to alternative investments over the next five years.10

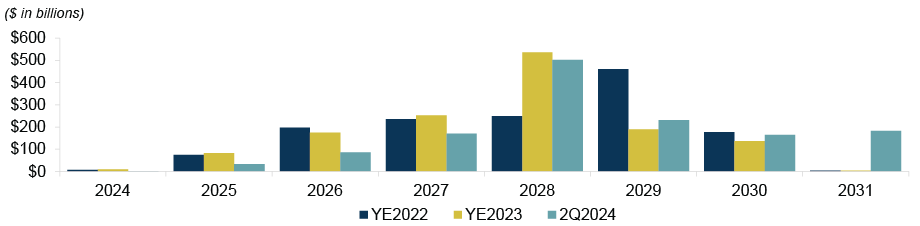

As a result of this surfeit of savings, heavily indebted companies have enjoyed far more liquidity than one would expect following a rapid increase in interest rates. Many below-investment grade companies have been able to extend maturities over the last year, especially companies that have issued in the loan market. At the end of last year, debt maturities in 2024-26 in the U.S. leveraged loan market stood at $268 billion. That number has since declined to $121 billion. (See Figure 4.) In fact, less than 9% of outstanding U.S. leveraged loans are now set to mature before 2026.11 Private credit has played a significant role in this trend, having refinanced roughly $20 billion of broadly syndicated loans in 2023.12

Figure 4: Maturities in U.S. Senior Loans Have Been Pushed Out

Source: PitchBook LCD, as of July 12, 2024

What Next?

Recent economic indicators suggest that struggles among middle- and lower-income consumers are beginning to intensify. Weekly initial jobless claims have spiked meaningfully in recent months, and unemployment levels in the U.S. have ticked up to 4.0%13 for the first time since 2021.

While declining inflation may enable the Fed to become slightly more dovish in the coming months, aggressive actions are unlikely at a time when capital market conditions are already quite accommodative. The Fed may want to provide some relief to consumers facing high prices and a softening labor market, but the Fed likely won’t want to do anything drastic (a) when it doesn’t need to (i.e., when unemployment remains relatively low) and (b) when access to financing has already become a lot easier for many businesses. While the Fed’s mandate doesn’t include popping equity market bubbles, the almost 20% YTD return for U.S. large-cap equities may give it pause, even if this rally has been driven by the performance of a few large companies.14

Ultimately, we believe we’ll continue to see conflicting economic and market signals for quite some time, so we think investors should remain patient before claiming “mission accomplished” on any front. That said, we believe that credit investors with limited legacy portfolio issues, capital to deploy, and a disciplined focus on diligent underwriting will be well positioned to earn attractive risk-adjusted returns in this complex market environment.

Credit Markets: Key Trends, Risks, and Opportunities to Monitor in 3Q2024

(1) The Spike in CLO Volumes Could Benefit CLO Equity Investors but Also Reduce Quality in the Loan Market

In the second quarter of 2024, CLO issuance hit record-high levels in both the U.S. and Europe. In the U.S., CLO issuance has reached $104.6 billion in the year to date, compared to $55.96 billion over the same period in 2023.15 Investor demand for CLO debt has soared in recent months primarily because CLOs offer much wider spreads than investment grade corporate bonds, while also appearing to offer a low risk of default. Demand has largely been driven by:

- retail investors accessing the asset class via the CLO ETF market, which has doubled in size since the end of 2023 and now exceeds $12 billion;16

- large amortizations among outstanding CLOs, which have returned an unprecedented $64 billion of capital to investors so far this year;17 and

- sustained appetite from Japanese banks, which have historically made up the largest segment of CLO owners.

This elevated demand has caused CLO spreads to narrow drastically over the last 18 months. The spreads of AAA-rated CLO debt – the largest segment of a CLO – have recently contracted to roughly 150 basis points in the U.S., from a high of over 230 basis points in 4Q2022.18 This trend has created a very supportive technical environment for senior loans, as CLOs hold a majority of this market. This, in turn, has benefited CLO equity investors, as they profit when the cost of CLO liabilities (i.e., CLO debt tranches) declines relative to the value of CLO assets (i.e., the portfolio of senior loans).

Moving forward, the biggest obstacle in creating CLOs may be sourcing sufficient assets. While loan issuance has risen from the lows seen in 2022-23, the supply of new loans remains limited. Nearly 90% of U.S. loan issuance in 2Q2024 was related to refinancing or repricing activity, meaning the overall supply of loans hasn’t expanded meaningfully.19

Due to this constraint in loan supply, CLO managers who need to build their portfolios may be tempted to lower their credit underwriting standards. This could ultimately increase risk in the loan market, while generating opportunities for patient, disciplined investors with strong credit-picking skills.

(2) Markets Are Beginning to Price in a Less Dovish Interest Rate Environment

While it’s becoming increasingly likely that the Federal Reserve will soon cut interest rates, the Treasury yield curve is beginning to indicate that we may truly be in a new interest rate era.

The yield curve shifted upward during the second quarter, as the 10-year Treasury yield rose by 20 bps over the period to 4.4%. Additionally, at quarter-end, the market was only pricing in roughly 45 bps of interest rate cuts before year-end, down from almost 70 bps at the start of the quarter and the nearly 170 bps, or around seven 2024 cuts, reflected in the curve in mid-January.20 This less-dovish forecast is in line with the Fed’s “dot plot” of interest rate expectations that was released in June. It indicated that only one cut of around 25 bps is likely before year-end. The dot plot produced at the March meeting had suggested that we could see three cuts by December 31.

Meanwhile, at quarter-end, the yield curve also appeared to reflect mounting concerns about the size of the U.S. deficit. This concern is likely being exacerbated by the fact that none of the major candidates running for the U.S. presidency have made cutting the deficit a priority. The market seems particularly concerned about the inflationary potential of some of former President Donald Trump’s fiscal policies, as evidenced by the roughly 20 bps spike in the 10-year Treasury yield in the two days following President Joe Biden’s poor debate performance. This particular move was notable given that a lower-than-expected PCE inflation report was released on the day following the debate.

We believe this environment will create attractive opportunities for investors focused on income, but only if they can avoid the credit pitfalls.

(3) Banks Have Increasingly Been Able to Offload Risk

High cash reserves among U.S. corporations and elevated savings among consumers in high income deciles have helped to stabilize the U.S. banking sector after the ructions seen in early 2023. In the aftermath of the regional bank crisis, multiple U.S. banks sought to quickly increase liquidity, including through the use of synthetic risk transfers (SRT). Although liquidity conditions have improved since early 2023, U.S. banks’ use of SRTs is likely to continue growing, particularly now that the Federal Reserve has provided more guidance about banks’ ability to offload risk through these instruments.

In essence, an SRT is structured as follows:

- A bank enters a contract with an investor, whereby the investor assumes the risk of future losses in a credit pool in exchange for receiving coupon income. This contract is a form of structured credit (i.e., a credit protection note).

- The bank effectively removes their credit risk exposure, while avoiding having to sell any underlying assets, some of which may be trading at a discount.

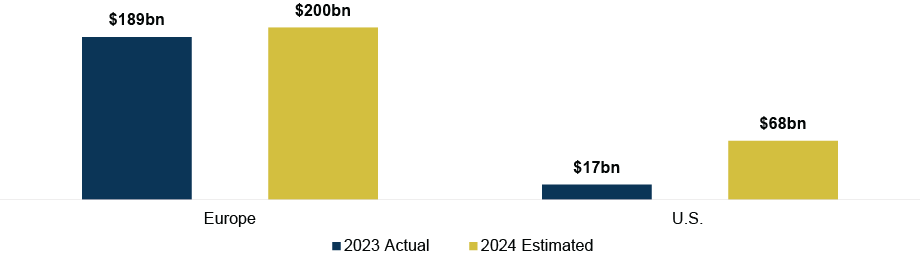

SRT has long been used in Europe, primarily because the stricter regulatory environment has forced banks to seek effective ways to raise regulatory capital. But the U.S. is likely to catch up quickly. It’s estimated that SRT issuance in the U.S. in 2024 will be roughly quadruple the 2023 levels, as the banking sector seeks to generate liquidity and free up capital. (See Figure 5.)

However, it’s important to note that SRT does not remove the underlying risk of bad loans; it’s just that the investor, not the bank, would bear the impact of defaults. Investors must carefully scrutinize the pool of assets to ensure that they are being adequately compensated for the risk.

Figure 5: SRT Is Expected to Grow Meaningfully in the U.S. in 2024

Source: Bank of America estimates, as of March 2024

Assessing Relative Value

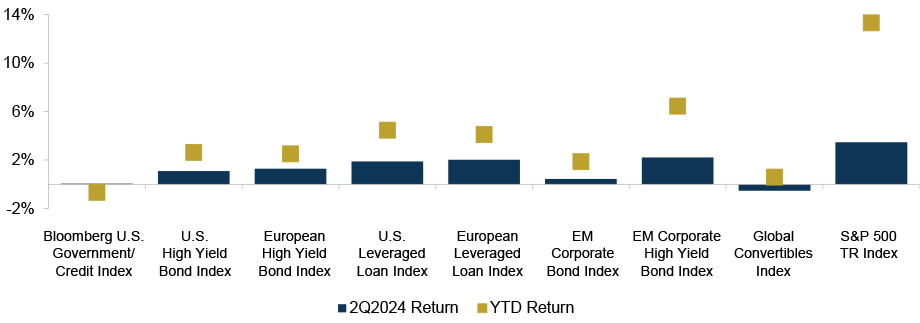

Performance of Select Indices

As of June 30, 2024

Source: Bloomberg, Credit Suisse, ICE BofA, JP Morgan, S&P Global, Thomson Reuters21

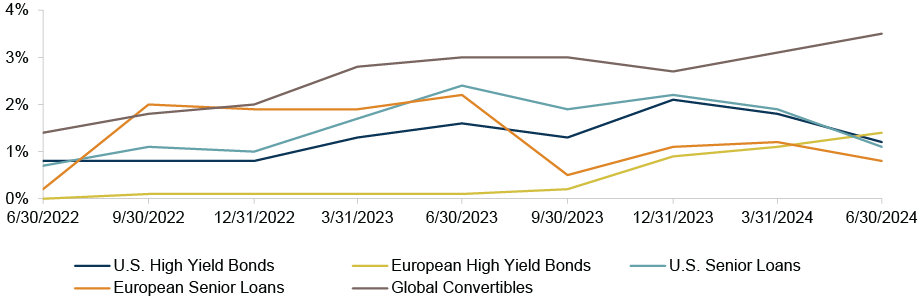

Default Rates by Asset Class

Source: JP Morgan for high yield bonds; Credit Suisse for loans through 2Q2023, UBS since 3Q2023; Bank of America for Global Convertibles

Note: Data represents the trailing-12-month default rate; excludes distressed exchanges

Strategy Focus

High Yield Bonds

Market Conditions: 2Q2024

U.S. High Yield Bonds – Return: 1.1%22 | LTM Default Rate: 1.2%23

-

Yield spreads were relatively unchanged in 2Q2024: They remained near the low end of the historically normal range of 300–500 bps during the period.24

-

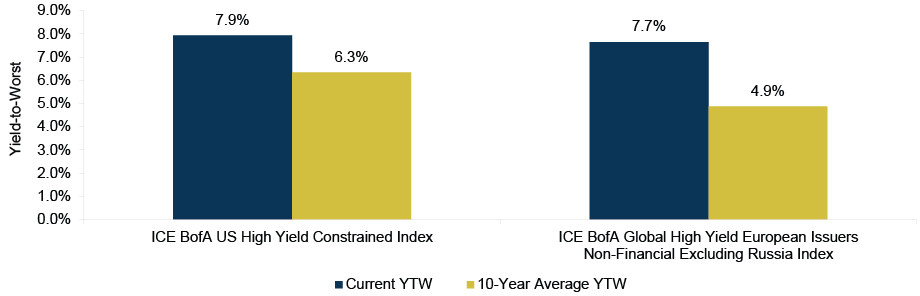

Yields in the asset class rose slightly: They increased modestly in 2Q2024 due to the incremental rise in Treasury yields and are well above the ten-year average. (See Figure 6.) Over 40% of high yield bonds had yields above 7% at quarter-end, compared to less than 7% at the beginning of 2022.25

-

Higher-quality bonds outperformed: BB-rated bonds, the highest-rated portion of the below-investment grade universe, returned 1.3% for the period, followed closely by B-rated bonds, which returned 1.0%. CCC-rated bonds, the lowest-rated segment of the market, were up by only 0.1%.

European High Yield Bonds – Return: 1.3%26 | LTM Default Rate: 1.4%27

-

The asset class generated a modest return during the quarter: Returns were primarily driven by coupon payments, as price appreciation was limited.

-

The lowest-quality segment of the market outperformed: CCC-rated bonds returned 1.9% for the period, compared to 1.1% and 1.0% for BB-rated and B-rated bonds, respectively. This outperformance was primarily driven by the recovery among European corporates in the real estate sector.

-

Investors will likely continue to enjoy attractive yields: Since substantial near-term interest rate cuts remain unlikely, yields in the asset class should stay above the ten-year average through at least the remainder of 2024.

-

High yield bonds are trading at a discount to par: The average price at quarter-end was 93 cents on the dollar and 92 cents on the euro in the U.S. and European markets, respectively. Thus, investors have the potential to enjoy capital appreciation while retaining strong call protection.

-

Default risk remains low: Quality in the asset class is high. The percentage of BB-rated bonds in the U.S. market is near a ten-year high. Maturities through 2026 have also declined considerably in the last year.

-

There is significant uncertainty surrounding the upcoming U.S. presidential election: Policy changes could quickly impact corporate taxes, the budget deficit, and U.S. national debt.

-

Elevated inflation and high labor costs may impair issuers’ fundamentals: Even though inflation has slowed, many input costs are still high.

Figure 6: The High Yield Bond Market Continues to Offer Attractive Yields

Source: ICE BofA US High Yield Constrained Index and ICE BofA Global High Yield European Issuers Non-Financial Excluding Russia Index, as of June 30, 2024

Senior Loans

Market Conditions: 2Q2024

U.S. Senior Loans – Return: 1.9%28 | LTM Default Rate: 1.1%

-

U.S. senior loan prices rose in the second quarter: Performance in the asset class was positive during the period as CLO origination rose and repricings/refinancings of outstanding loans remained elevated.

-

Gross issuance increased in the asset class: Activity in the loan primary market continued at a feverish pace in the second quarter, though it continued to be dominated by refinancings and repricings. There has been over $700mm of issuance in the year-to-date, which is meaningfully higher than the pace seen in the first half of 2023. However, new-money deals (i.e., excl. refinancings/repricings) remain limited.

European Senior Loans – Return: 2.0%29 | LTM Default Rate: 0.8%

-

European loans generated a solid return in 2Q2024: Returns were primarily driven by strong coupon income as well as modest price appreciation.

-

Lower-quality loans underperformed: CCC-rated loans, the lowest-quality portion of the senior loan market, returned 0.3% in the period, while B- and BB-rated loans returned 2.2% and 1.6%, respectively.

-

High coupons may continue to attract investors: Floating-rate loans will likely remain compelling through the end of 2024, unless there is a meaningful decrease in reference rates.

-

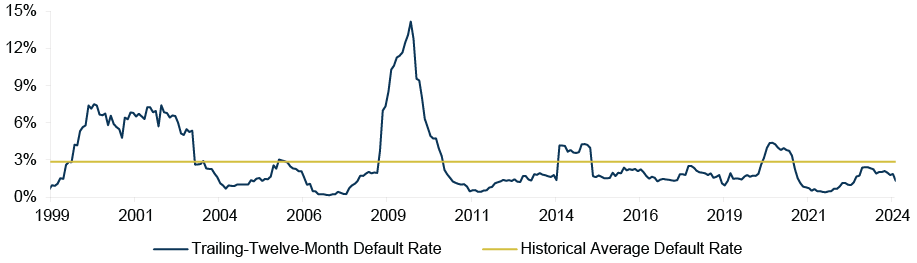

The default outlook appears manageable: Loan default rates in the U.S. and Europe are expected to rise in 2024 and will likely exceed those in both region’s high yield bond markets. However, default rates are expected to stay below their recessionary averages, even if these economies begin to contract. (See Figure 7.) This is primarily due to the limited number of maturities in 2024 and 2025 and the availability of other sources of capital, such as rescue financings.

-

Loans may experience less volatility than other asset classes because of loans’ stable buyer base: CLOs, the primary holders of leveraged loans, have limited selling pressure, and the asset class tends to attract long-term institutional investors due to the lengthy cash settlement period.

-

Recovery rates are well below the historical average: The increased prevalence of loan-only capital structures has caused average recovery rates in the asset class to decline to 42%.30 We anticipate that this trend will continue through this default cycle.

-

Declining interest rates could reduce appetite for floating-rate assets: Although interest rates are still above their ten-year average, many market participants expect cuts before year-end, which could negatively impact demand for floating-rate assets.

Figure 7: Default Rates Remain Below the Historical Non-Recessionary Average

Source: J.P. Morgan, as of June 30, 202431

Investment Grade Credit

Market Conditions: 2Q2024

Return: 0.1%32

-

Investment grade debt strengthened modestly in 2Q2024, as coupon income offset the negative impact of rising Treasury yields: Higher-than-expected inflation in April reduced expectations for interest rate cuts in 2024, which caused bond yields to increase. But inflation slowed throughout the quarter and thus yields declined from the highs seen in April.

-

Lower-quality credit outperformed: BBB-rated bonds – the lowest investment grade tier – outperformed the highest-rated segment by over 110 bps in 2Q2024. This was largely because the lower-rated segment has the shortest average duration and highest yields in investment grade credit.

-

Issuance was extremely robust during the quarter: Gross issuance of investment grade bonds in the period totaled $355bn.33 This strong activity reflects the consensus expectation that interest rates will soon decline, the relatively attractive yields still available in the asset class, and the excess liquidity in the financial system.

-

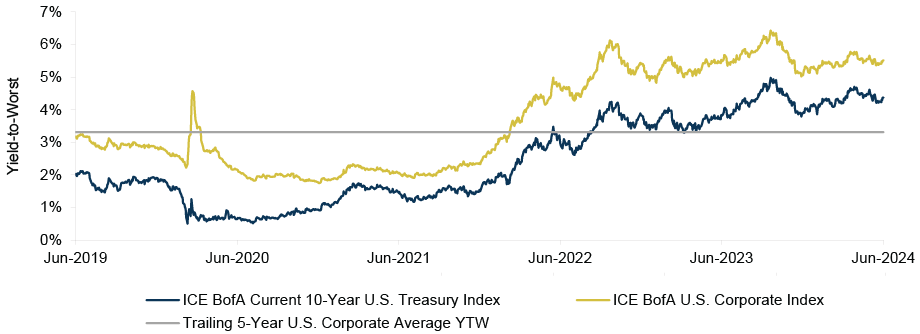

Investment grade corporate debt yields remain elevated: Yields in the asset class ended the quarter at 5.5%, which is considerably higher than the five-year average. (See Figure 8.)

-

Investment grade debt may benefit if economic activity slows: Investment grade debt could outperform high yield bonds if risk sentiment sours, yield spreads widen, and interest rates decline.

-

All fixed-rate asset classes could suffer if interest rates stay elevated: Interest rates were volatile throughout 2Q2024. While investors now expect roughly two interest rate cuts before year-end, the Fed’s actions could prove to be less dovish than investors currently anticipate.34

-

If interest rates decline meaningfully in 2024, demand for low-yielding fixed income securities could decline: While investment grade credit will benefit more from interest rate cuts than high yield bonds due to the former’s longer duration, a significant decline in yields could reduce demand for investment grade credit. Investors that need to achieve a particular yield may gravitate toward asset classes offering higher yields.

Figure 8: Investment Grade Bond Yields Remain Well Above the Five-Year Average

Source: Bloomberg

Emerging Markets Debt

Market Conditions: 2Q2024

EM Corporate High Yield Bonds – Return: 2.1%35

-

EM high yield corporate debt maintained strong momentum during the quarter: The steady performance was driven by high yields and modest yield spread tightening. While EM bond yields remain elevated, spreads in the asset class are currently the tightest they’ve been in six years, and the premium versus U.S. high yield spreads has narrowed. (See Figure 9.)

-

EM bonds experienced few defaults during the period: In the first half of 2024, only 1.8% of EM bonds have defaulted or been involved in a distressed exchange. This is well below the elevated levels recorded since 2021, which had largely been driven by defaults in China and European emerging markets.

-

The asset class saw issuance rebound and retail fund flows stabilize: Issuance in 2024 has already surpassed the total volume recorded in 2023, with a significant contribution from companies in Brazil and Turkey. However, the pace of issuance is still considerably lower than the norm seen before the start of the global interest rate tightening cycle. Retail fund flows turned modestly positive during the quarter, following $6bn of outflows from the asset class in 1Q2024.36

-

EM debt performed well despite the increased focus on Latin American political risks: EM bond prices benefited as global risk appetite increased. However, political issues in certain EM countries intensified, particularly in Latin America, where currencies experienced one of the worst quarters in the past decade. Investors have grown concerned about the potential weakening of institutional guardrails in Mexico and the deteriorating fiscal situations in Brazil, Colombia, and Panama. Additionally, politics in developed markets, especially the upcoming U.S. presidential elections, remain a significant concern, primarily due to the potential negative implications for trade policy.37

-

EM debt investors have bargaining power: Nearly 14% of EM corporate bonds mature within one year, a record-high level.38 Meanwhile, financing options for stressed EM borrowers are limited, meaning skilled EM credit investors have the opportunity to earn high yields while receiving enhanced investor protections in the primary market and in liability management transactions.

-

Attractive investment opportunities remain, despite the recent rally: The asset class offers an elevated average yield of 8.5%, and the average price is still low at 92 cents on the dollar.39

-

The EM default outlook is manageable: The EM default rate in 2024 is expected to be below the historical average of 4.0%.40 This forecast reflects EM issuers’ resilient fundamentals. In 2024, we’ve seen a decrease in the number of defaults in China’s real estate sector and among companies impacted by the Russia/Ukraine War.41

-

The slowdown in global economic activity could weigh on EM industries and export-based economies: The increase in borrowing costs in many markets and continued weakness in China’s economy has lowered expectations for near-term global growth. If global demand for commodities declines, many EM country and company fundamentals could be negatively impacted.

-

Geopolitical tensions may have negative long-term effects on EM debt capital flows: While geopolitical risk hasn’t weighed heavily on EM debt performance in recent quarters, investor confidence in EM credit could decline if ongoing conflicts escalate or if China/U.S. relations worsen.

Figure 9: EM Corporate Debt Yield Spreads Have Narrowed to Multi-Year Lows in 2024

Source: JP Morgan Corporate Broad CEMBI Broad Diversified High Yield, as of June 30, 2024

Global Convertibles

Market Conditions: 2Q2024

Return: -0.5%42 | LTM Default Rate: 3.5%43

-

Global convertibles’ performance was weak in 2Q2024 despite rising equity prices: The convertibles index failed to benefit from booming equity markets, largely because the equity rally continues to be driven by the strong performance of a few large companies. Average stock price movements among all companies have been more subdued in recent quarters, with notable underperformance by small-cap stocks.

-

Primary market activity remained strong: In 2Q2024, new issuance of global convertibles totaled $34.9bn across 51 new deals. Issuance in the U.S. was dominated by refinancings, while many of the large new deals in Asia were used to fund share buybacks.

-

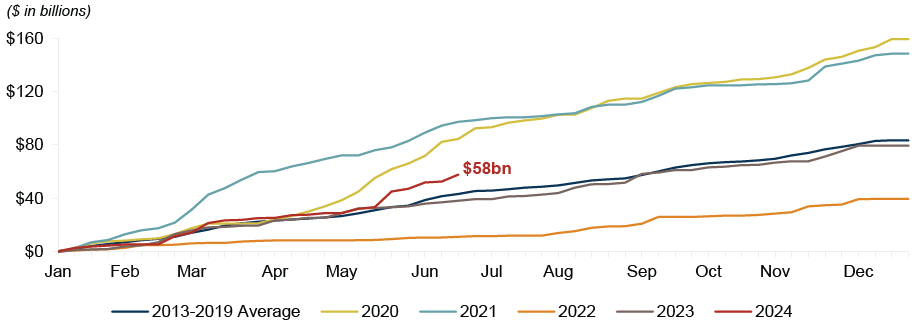

The size and quality of the convertible bond market has improved: In an elevated interest rate environment, companies seeking new capital or those looking to refinance straight debt have increasingly turned to the convertibles market, where coupons are lower. In 2024, new issuance of global convertible bonds has been running at the fastest pace seen since 2021. (See Figure 10.) After a strong first half of the year, FY2024 issuance targets have been revised higher. Importantly, over 30% of the volume in 2024 thus far has had investment grade credit ratings.

-

Underlying equity valuations remain attractive: The Russell 2000 Index, which is closely correlated with convertibles, currently trades at a meaningful discount to the S&P 500 Index. The valuations of the underlying equities appear particularly reasonable when considering the growth prospects of many companies in the index.

-

Numerous trends threaten to slow global economic growth and weigh on equity prices: These include concerns about sticky inflation and heightened geopolitical risk.

-

Strength in the equity market may remain concentrated: The ongoing equity rally has been driven by a small number of large-cap technology companies. Historically, robust rallies with limited breadth have often ended poorly.44

Figure 10: New Issuance of Global Convertibles Is Running at the Fastest Pace Since 2021

Source: BofA Global Research, as of June 14, 2024

Structured Credit

Market Conditions: 2Q2024

Corporate – BB-Rated CLO Return: 4.5%45 | BBB-Rated CLO Return: 2.9%46

-

Collateralized Loan Obligations strengthened in 2Q2024: Declining recession fears and attractive yields fueled investor demand for CLOs in the period. BB-rated CLOs outperformed, primarily due to their relatively high average yields.

-

Activity in the primary market remains robust: CLO issuance was strong during the second quarter, with volumes in May reaching the second-highest level on record. Issuance of CLOs in the U.S. exceeded $50bn in the period, up from $28bn in 1Q2024 and $30bn in 4Q2023. Issuance in Europe totaled €14bn compared to €11bn in 1Q2024.47

Real Estate – BBB-Rated CMBS Return: 4.8%48

-

Real estate structured credit enjoyed positive performance in 2Q2024: The asset class benefited from improving investor sentiment about the real estate sector, which was largely driven by expectations that interest rates have peaked in this cycle.

-

Performance in the CRE market varied significantly by sector: Green Street’s Commercial Property Price Index49 increased by 0.7% quarter-over-quarter but decreased by 5.9% year-over-year.50 The office subsector index was essentially unchanged quarter-over-quarter, but it declined by 8.7% year-over-year.51 Nearly all sectors suffered annual declines, but the moderation on a quarterly basis suggests that the market may be stabilizing.

-

Primary market activity has accelerated meaningfully in 2024: In the first half of the year, total private label issuance of commercial mortgage-backed securities was just over $47bn, an increase of 148% compared to the same period last year. CMBS issuance in 2024 will be more than double last year’s modest volume if the current pace of issuance continues.

-

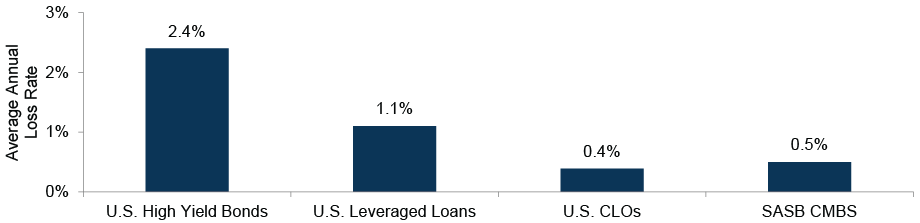

Corporate structured credit offers higher average yields than traditional credit asset classes: CLOs have attractive yields as well as strong structural enhancements, evidenced by their low long-term loss rates. (See Figure 11.)

-

Declining recession fears have increased investors’ risk appetite: As the market shows signs of recovery, BB- and BBB-rated CLOs have become more attractive and can enhance returns for the asset class.

-

Depressed valuations in the CMBS market may generate attractive opportunities for disciplined investors: Investors with available capital and limited problems in their existing portfolios may be well positioned to take advantage of these opportunities. But in this challenging environment, it will be especially important to (a) conduct disciplined credit analysis and (b) remain senior in the capital structure.

-

CLOs have historically experienced increased volatility during bouts of equity market weakness: Equity markets could fall if interest rates aren’t cut as quickly as investors currently anticipate. Moreover, CLO performance might be negatively affected if investor risk appetite declines for other reasons or if the loan market experiences a large wave of downgrades and/or defaults.

-

Weakness in the office sector may persist: The sector continues to face multiple headwinds, and its performance will likely continue to weigh on real estate structured credit indices throughout 2024.

Figure 11: Structured Credit Has Historically Had Lower Loss Rates than Traditional Credit

Source: JP Morgan Research (High Yield Bonds, 1978-2024), J.P. Morgan Research (Leveraged Loans, 1998-2024), Moody’s (CLOs, 1993-2023, updated annually), J.P. Morgan Research (SASB CMBS and large loan floaters, 1996-2024), as of March 31, 2024, updated quarterly unless otherwise stated.

Private Credit

Market Conditions: 2Q2024

-

U.S. private credit default rates rose modestly quarter-over-quarter: The default rate by issuer count was 2.7% in 2Q2024, up from 1.8% in 1Q2024.52

-

European private credit deal volume and average size have continued to increase: Deal volume in the asset class rebounded in 2023 following the substantial decline seen in 2021. This was largely driven by expectations of interest rate cuts in 2024. Deal size in the European market has also grown, as evidenced by the record-breaking €4.5bn private credit facility recently provided to Adevinta, an online classified ad company.

-

M&A momentum slowed in 2Q2024: While investors were optimistic in January that we’d seen a meaningful increase in dealmaking, M&A activity has since been sluggish due to lingering uncertainty regarding high interest rates, lofty valuations, and the upcoming U.S. presidential elections. Deal volume in 1H2024 was down by 30% compared to the first half of 2023.53 However, in recent weeks, we’ve seen an increase in sales discussions and due diligence conversations, which we believe could translate into increased dealmaking activity in the second half of 2024.

-

Demand for capital solutions with bifurcated structures appears to be growing: Portfolio companies that require additional capital are increasingly choosing to issue junior debt to avoid repricing their existing senior debt. Companies continue to favor bifurcated structures (which include both senior and junior debt) over unitranche capital solutions because the former typically offers more flexibility, including a combination of fixed- and floating-rate debt.

-

Despite sluggish M&A activity, private credit activity is the busiest it has been in five years: In 2Q2024, a boom in refinancings and recapitalizations caused the volume of directly originated private credit loans to reach the highest level in several years.54 During the first quarter, the distribution of non-leveraged buyout (LBO) financing deals in the broadly syndicated loan and private credit markets was relatively balanced. However, in the second quarter, private credit regained market share, financing close to 60% of non-LBO deals completed in the period.55

-

A surge in retail fundraising is fueling rapid deployment: The assets under management of business development companies (BDC) have grown by roughly 255% since 2020.56 (See Figure 12.) To keep pace with this significant increase of inflows and prevent cash buildup, managers may prioritize deployment over rigorous selectivity, occasionally accepting deal terms that other lenders might consider too borrower-friendly. This strategy could ultimately increase overall risk within their portfolios.

-

Liquidity pressures have resulted in increased demand for PIK-only structures: Companies facing higher interest costs and muted earnings growth are increasingly seeking to bolster liquidity by issuing junior debt and preferred equity tranches that are entirely paid in kind. This can help sponsors avoid having to inject additional cash equity. However, we remain skeptical about the long-term efficacy of this strategy, as we believe liquidity concerns won’t truly be resolved for companies with unsustainable capital structures unless the fed funds rate falls to approximately 2% in the near to medium term, an outcome we don’t consider likely.

Figure 12: The Surge in Retail Fundraising Is Fueling Rapid Deployment

Source: BDC Collateral and Wells Fargo Securities, as of March 31, 2024

Oaktree’s Performing Credit Platform

Oaktree Capital Management is a leading global alternative investment management firm with expertise in credit strategies. Our Performing Credit platform encompasses a broad array of credit strategy groups that invest in public and private corporate credit instruments across the liquidity spectrum. The Performing Credit platform, headed by Armen Panossian, has $87.3 billion in AUM and approximately 190 investment professionals.57

Endnotes

- 1McKinsey, as of May 2024.

- 2Household Debt Service Payments as a Percent of Disposable Personal Income, Federal Reserve Bank of St. Louis.

- 3Federal Reserve Bank of New York, as of March 31, 2024.

- 4Federal Reserve Bank of St. Louis, as of March 31, 2024.

- 5Forbes, as of April 2024.

- 6Bloomberg, as of March 2024.

- 7Goldman Sachs.

- 8Bank of America.

- 9LSTA, BDC Quarterly Wrap: 1Q24, as of June 20, 2024.

- 10Bank of America.

- 11PitchBook LCD, as of July 12, 2024.

- 12PitchBook LCD, as of June 30, 2024.

- 13Federal Reserve Bank of St. Louis, as of June 2024.

- 14S&P 500, as of July 16, 2024.

- 15PitchBook LCD, as of June 30, 2024.

- 16Bloomberg.

- 17Bank of America estimates, as of June 2024.

- 18PitchBook LCD.

- 19PitchBook LCD.

- 20Bloomberg.

- 21The indices used in the graph are Bloomberg Government/Credit Index, Credit Suisse Leveraged Loan Index, Credit Suisse Western European Leveraged Loan Index (EUR hedged), ICE BofA US High Yield Index, ICE BofA Global Non-Financial HY European Issuers ex-Russia Index (EUR Hedged), Refinitiv Global Focus Convertible Index (USD Hedged), JP Morgan CEMBI Broad Diversified Index (Local), JP Morgan Corporate Broad CEMBI Diversified High Yield Index (Local), S&P 500 Total Return Index.

- 22ICE BofA US High Yield Constrained Index for all references to U.S. High Yield Bonds, unless otherwise specified.

- 23JP Morgan for all U.S. default rates, unless otherwise specified. This figure excludes distressed exchanges.

- 24The normal range refers to the average range over the last 25 years.

- 25ICE BofA US High Yield Constrained Index. Percentages are based on the market value of debt.

- 26ICE BofA Global Non-Financial High Yield European Issuer, Excluding Russia Index (EUR hedged) for all references to European High Yield Bonds, unless otherwise specified.

- 27UBS for all European default rates, unless otherwise specified.

- 28Credit Suisse Leveraged Loan Index for all data in the U.S. Senior Loans section, unless otherwise specified.

- 29Credit Suisse Western Europe Leveraged Loan Index (EUR Hedged) for all data in the European Senior Loans section, unless otherwise specified.

- 30JP Morgan, LTM average rate, as of March 31, 2024. Default figures exclude distressed exchanges.

- 31TXU was removed from J.P. Morgan’s twelve-month default rate calculation in April 2015 resulting in a meaningful decrease in the rate in March 2015.

- 32ICE U.S. Corporate Index for all data in this section, unless otherwise specified.

- 33BofA Securities IG Syndicate Deal Recap.

- 34As of June 30, 2024.

- 35JP Morgan Corporate Broad CEMBI Diversified High Yield Index for all data in this section unless otherwise specified. The emerging markets debt section focuses on dollar-denominated high yield debt issued by companies in emerging market countries.

- 36Bloomberg, JP Morgan, as of June 28, 2024.

- 37Bloomberg, as of June 28, 2024.

- 38JP Morgan, as of February 26, 2024.

- 39Bloomberg, JP Morgan, as of June 28, 2024.

- 40JP Morgan, default rate for Corporate CEMBI High Yield Index, as of July 5, 2024.

- 41Bloomberg, JP Morgan, as of June 28, 2024.

- 42Refinitiv Global Focus Convertible Index for all performance data, unless otherwise indicated.

- 43Bank of America for all default and issuance data in this section, unless otherwise specified.

- 44Large-cap stocks are represented by the S&P 500 Index, technology-heavy stocks are represented by the NASDAQ Index, and small-cap stocks are represented by the Russell 2000 Index.

- 45JP Morgan CLOIE BB Index.

- 46JP Morgan CLOIE BBB Index.

- 47JP Morgan for all data in this section, unless otherwise specified.

- 48Bloomberg US CMBS 2.0 Baa Index Total Return Index Unhedged Index.

- 49Index tracks the pricing of institutional-quality commercial real estate.

- 50Green Street Commercial Property Index, as of July 1, 2024.

- 51Green Street Commercial Property Index, as of July 1, 2024.

- 52Proskauer Private Credit Default Index, as of June 30, 2024. Default rates are calculated by dividing the number of defaulted loans by the aggregate number of loans in the index.

- 53LSEG and PwC, as of June 25, 2024. Note: To facilitate meaningful comparisons with prior half-yearly periods, the data for the first half of 2024 covers the first five months of the year, extrapolated to represent a six-month period.

- 54Pitchbook LCD, as of July 3, 2024.

- 55Pitchbook LCD, as of July 3, 2024.

- 56BDC Collateral & Wells Fargo Securities, as of March 31, 2024.

- 57The AUM figure is as of June 30, 2024 and excludes Oaktree’s proportionate amount of DoubleLine Capital AUM resulting from its 20% minority interest therein. The total number of professionals includes the portfolio managers and research analysts across Oaktree’s performing credit strategies.

Notes and Disclaimers

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker dealer, investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

This document, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of Oaktree Capital Management, L.P. (together with its affiliates, “Oaktree”). By accepting this document, you agree that you will comply with these restrictions and acknowledge that your compliance is a material inducement to Oaktree providing this document to you.

This document contains information and views as of the date indicated and such information and views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree believes that such information is accurate and that the sources from which it has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.

© 2024 Oaktree Capital Management, L.P.

Informações sensíveis e divulgação

Este memorando expressa as opiniões do autor na data indicada e tais opiniões estão sujeitas a alterações sem aviso prévio. A Oaktree não tem a obrigação de atualizar as informações aqui contidas. Além disso, a Oaktree não faz nenhuma representação, e não se deve assumir que odesempenho dos investimentos passados é uma indicação de resultados futuros. Além disso, onde quer que haja potencial de lucro, também existe a possibilidade de prejuízo. Este memorando está sendo disponibilizado apenas para fins educacionais e não deve ser usado para qualquer outro propósito. As informações contidas neste documento não constituem e não devem ser interpretadas como uma oferta de serviços de consultoria ou uma oferta de venda ou solicitação de compra de quaisquer títulos ou instrumentos financeiros relacionados, em qualquer jurisdição. Certas informações contidas neste documento sobre tendências econômicas e desempenho são baseadas ou derivadas de informações fornecidas por fontes terceirizadas independentes. A Oaktree Capital Management, L.P. (“Oaktree”) acredita que as fontes das quais tais informações foram obtidas são confiáveis; no entanto, não pode garantir a exatidão de tais informações e não verificou de forma independente a exatidão ou integridade de tais informações ou as suposições nas quais tais informações se baseiam. Este memorando, incluindo as informações aqui contidas, não pode ser copiado, reproduzido, republicado ou postado na íntegra ou parcialmente, em qualquer formato, sem o consentimento prévio, por escrito, da Oaktree.