MP3 reflationary policies injected massive amounts of money and credit into economies, leading to self-reinforcing high nominal growth, leading to self-reinforcing inflation, leading to an abrupt shift in market discounting from a benign monetary policy to a rapid tightening. This discounting of a sharp tightening, its knock-on effects across markets, and the early stages of an actual tightening are producing the first transition in the economic environment since MP3 policies were enacted. We are still in the early stages of this transition, and the path will depend a lot on how central bankers play their difficult hand, so one should not be firmly committed to one scenario or another. But as things now stand, odds favor a stagflationary environment that could last for years.

MP3 policies were very successful, stimulating a high level of nominal demand and a rapid recovery in employment markets in response to the pandemic. But this stimulation was applied for too long, and the offsetting monetary tightening is now coming too late, resulting in what we now have, which is a monetary inflation. Given the inertia of a monetary inflation, bringing it under control to the point that inflation approaches what is now discounted in the markets (2.5%) will require an aggressive tightening of monetary policy over a sustained period, and a significant and sustained weakening of employment markets. As central banks pursue their dual mandate of maximum employment and stable prices, they will not be able to achieve both at the same time and will be forced to choose between too-low growth in order to achieve their desired inflation rate, or too-high inflation in order to achieve their desired employment conditions. In managing through this, we see them toggling back and forth in their prioritization, trying to avoid both an unacceptably deep economic contraction and an unacceptably high inflation rate, culminating in a long period of too-high inflation and too-low growth, i.e., stagflation.

The markets are discounting a very different scenario. They are discounting one sharp round of tightening—comprised of a rise in short-term interest rates to just above 3%, combined with more than $400 billion of contraction of the Fed’s balance sheet—and that this will be enough to bring inflation down to 2.5% with stable growth and no dent in earnings. From there, markets are discounting that the achievement of these goals would allow a subsequent 1% drop in rates from their peak.

Asset returns are driven by how conditions unfold in relation to what is discounted. Our approach is to have an excellent reading of current conditions and a time-tested understanding of the cause/effect linkages, leading to a reliable probabilistic assessment of what comes next: an optimal response to known conditions. Today, our indicators suggest an imminent and significant weakening of real growth and a persistently high level of inflation (with some near-term slowing from a very high level). Combining this with what is discounted, the difference between what is likely to transpire in the near term and what is discounted is the strongest near-term stagflationary signal in 100 years, shown below. Longer term, as we play it out in our minds, we doubt that policy makers will be willing to tolerate the degree of economic weakness required to bring the monetary inflation under control quickly. More likely, we see good odds that they pause or reverse course at some point, causing stagflation to be sustained for longer, requiring at least a second tightening cycle to achieve the desired level of inflation. A second tightening cycle is not discounted at all and presents the greatest risk of massive wealth destruction.

Our leading estimates of inflation and real growth clearly paint the dilemma, as well as differences in the degree of stagflationary pressure across economies.

Data estimated through June 2022. Estimates based on Bridgewater analysis.

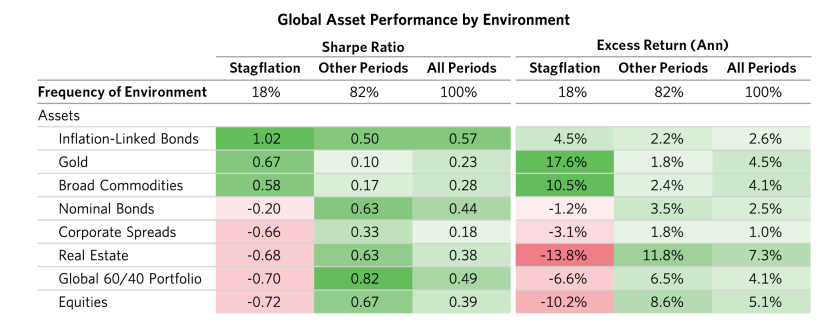

This mismatch between what is discounted and what is likely presents substantial ongoing risk to assets. The following table shows the historical returns of assets in stagflations and is compared to returns the rest of the time. Equities have been the worst-performing assets in stagflations.

Data estimated from January 1960 through April 2022. The global 60/40 is comprised of 60% hedged global equities and 40% hedged global nominal government bonds.

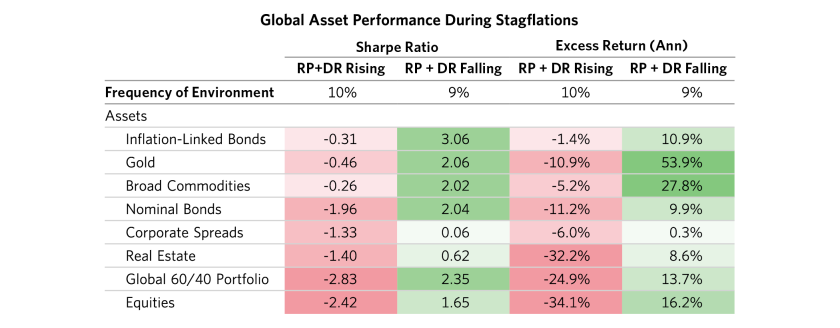

If a stagflation is accompanied by a tightening that drives risk premiums and discount rates up, the impacts are far worse, though the rank ordering of effects across assets is similar. On the other hand, if the policy response favors stimulating to support growth, assets tend to do well for some period of time even in stagflations.

Data estimated from January 1960 through April 2022. The global 60/40 is comprised of 60% hedged global equities and 40% hedged global nominal government bonds.

What Is a Monetary Inflation and Why Are We in It?

The core understanding required to assess this environment pertains to what constitutes a monetary inflation. By that we do not mean money supply. We are referring to a more complex process where there is an excess in the sources of funds coming from money, credit, and income that continues to fuel an excessive level of nominal spending in relation to the quantity of goods and services that labor produces. This perspective relies on two fundamental truths—that the sources of funds in an economy will equal uses of funds and that prices are driven by an exchange of money for quantity. Sources of funds will get spent, and if that causes an increase in the exchange of money for goods, services, or financial assets to outpace the quantity of those things offered, the price of those things goes up (and vice versa). The two perspectives are summarized below. The sources of funds coming from money, credit, and income must equal the uses of funds via spending, financial asset purchases, and cash reserves. And prices equal the amount of money exchanged for quantity.

This framework enables a full accounting attribution of inflation and nominal spending. For example, below we show that the excess of nominal spending (nominal GDP growth) relative to the growth in output from labor (“delta” headcount + productivity) naturally produces a change in prices (GDP deflator).

Data estimated through June 2022. Estimates based on Bridgewater analysis.

The normal definition of inflation is based on the CPI, which is intended to measure the cost of living and has a different mix of spending than GDP. Nonetheless, the CPI inflation is similar, and the attribution of CPI inflation would be perfectly accurate if the mix of goods purchased and the quantity produced was matched to the CPI index weights.

It is important to recognize that nominal GDP is a money phenomenon—it’s just how much money you spend, not what you got for your money. In the big stagflations of the ‘70s, nominal GDP never grew by less than 5%, even during big real GDP contractions. What happened is that the spending was absorbed by higher prices, leaving a contraction in real GDP. The same has also happened recently in some sectors—gasoline, for example. The sum of dollars spent for goods and services can be reconciled to the sources of funds. This is complex because sources of funds also go into financial assets (driving asset prices via $/Q) and cash. However, netting the flows through the system and plugging for statistical error, we can fully account for NGDP via the sources of funds.

Data estimated through June 2022. Estimates based on Bridgewater analysis.

Across these sources of funds, income growth establishes the base level of nominal spending. This is because spending produces income, and then that income gets spent, producing an income-spending flywheel that has inertia and thus tends to be self-sustaining. In the initial stages of this recovery, that surge in spending was received in the form of higher corporate profits and putting more people back to work. But as economies began to approach full employment, the expansion of labor (Q) could not keep up with the growth in demand ($), resulting in higher prices, including higher wages, which is simply the price of labor and reflects the same process of price formation as other prices. That stage marked the transition from beneficial recovery to self-reinforcing inflation and is still underway. The policy mistake was continuing to pump money and credit into the economy and keeping interest rates near zero as this transition occurred, rather than leaning into the wind at that time. Now the monetary inflation is entrenched via the inertia of the income-spending flywheel.

Data estimated through June 2022. Estimates based on Bridgewater analysis.

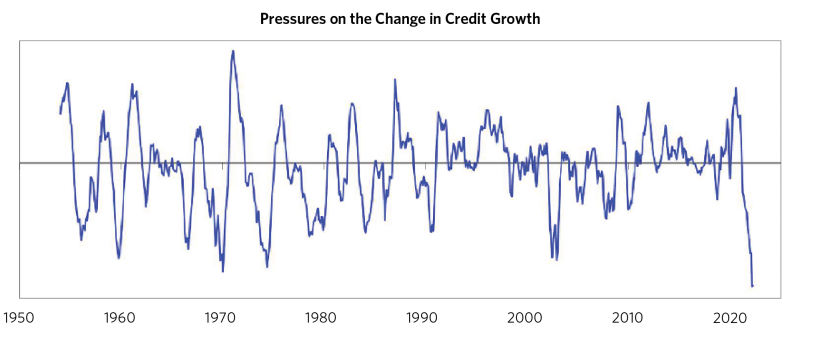

Policy makers move income and spending growth up or down by adjusting the flow of money and credit vis-à-vis monetary and fiscal policy. You raise NGDP growth by increasing credit growth, which enables an uptick in spending relative to what can be financed strictly from income, and this uptick in spending produces income, which gets spent, setting a new higher level for the income-spending flywheel. Slowing the flywheel requires a contraction in credit, which causes a rerouting of income from spending to debt reduction (including cash holdings) or simply less credit-financed spending, which reduces nominal spending, which reduces nominal income.

By our measures, even though the actual rise in short-term interest rates has not been much, the substantial discounting of the tightening with its knock-on effects through the markets, combined with the shift from QE to quantitative tightening (QT), suggests one of the most extreme downward pressures on money and credit of the past decades. In other words, we’re very likely to get a reduction in nominal spending in the near term.

Data estimated through June 2022. Estimates based on Bridgewater analysis.

The shift from QE to QT has its most direct impacts on financial markets. Applying the template described earlier in this letter, after the central bank prints money (M), it pushes that money into the economy through the financial markets (F). The impact on interest rates and asset prices indirectly influences spending. Over the past decade, the aggressive use of QE and then MP3 flooded financial markets with liquidity and caused them to substantially outperform the actual economy. The shift from QE to QT is having the reverse impact, drawing funds more directly from the financial markets and indirectly impacting spending. This, combined with ongoing heavy issuance of treasuries, is producing a liquidity hole in the financial markets that spreads from bonds to stocks and is likely to cause financial markets to underperform the economy.

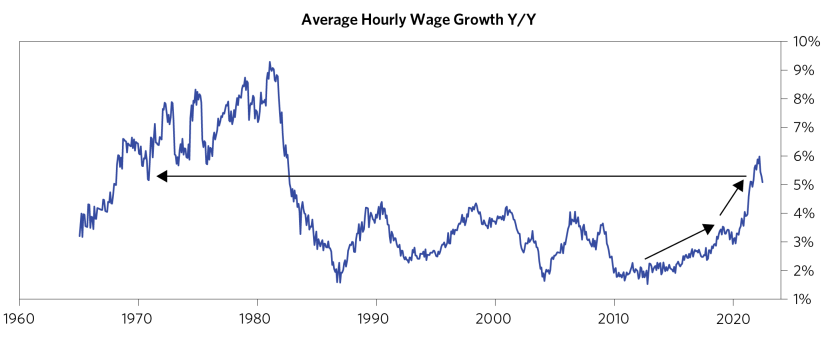

Policy tightening is likely to slow inflation from where it has been, but whether it brings inflation down to what is discounted (2.5%) and to what the Fed expects and is targeting (2%) depends on how deep the contraction is and how long it lasts. It needs to be deep and long-lasting because there is inertia in the system in the form of wage growth that is much higher than what would be required for 2.5% inflation.

Data estimated through June 2022. Estimates based on Bridgewater analysis.

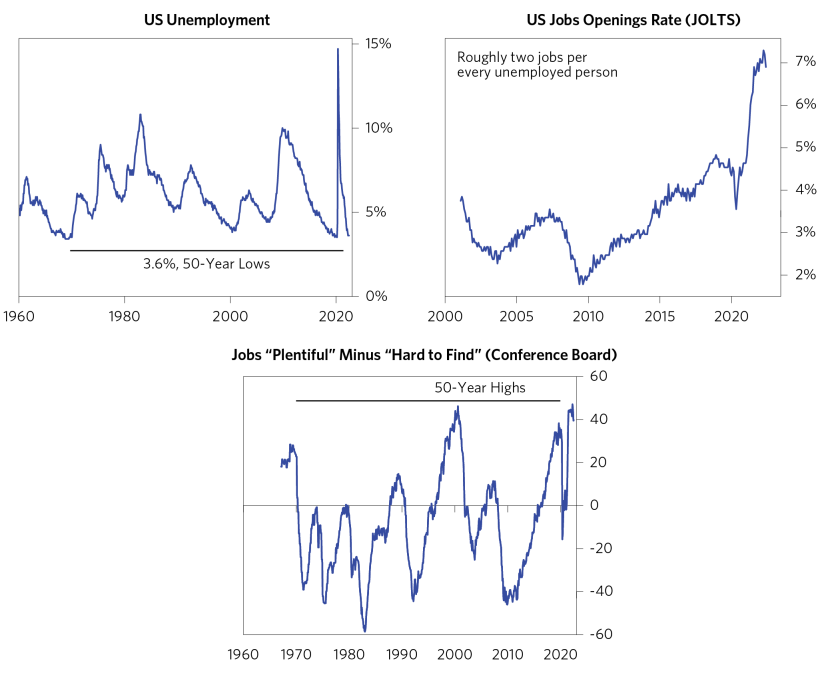

A big near-term decline in wages is unlikely because labor markets are now tight. The unemployment rate is near its lows, job offers are plentiful, and the cost of living is giving people reason to ask for more.

Data estimated through June 2022. Estimates based on Bridgewater analysis.

Thus, the degree and duration of the tightening must be strong enough and long-lasting enough to bring credit growth down by enough (roughly by half) for long enough—to bring spending down by enough for long enough—to weaken labor markets by enough—to bring wages down by enough—that NGDP growth falls by enough and stays there—to bring inflation down to 2.5%. Historically, the average lead time of a decline in labor markets to a decline in wages is about two years, with a wide range around that average.

As mentioned, we doubt the scenario that is now discounted in the markets and think that the odds of a protracted stagflation are much higher. Our systems suggest the same for the near term which now doubt the degree of near-term tightening that is discounted, the 2.5% terminal inflation rate that is now priced in, and the future level of earnings that is now priced in, reflecting instead the growing vulnerability of the dollar should those doubts prove true.

The above discussion is very US-centric. The mechanics work the same everywhere, but the circumstances vary by economy, mostly due to the differences in the policy response to the pandemic. Economies that applied the most aggressive MP3 policies have a bigger problem (e.g., Europe and the UK), though less than the US, and economies that applied less MP3 stimulation have a lesser problem (e.g., China and Japan). The war in Ukraine has added to the problem in varying degrees as a function of the direct supply vulnerabilities, with the biggest impact on Europe and the least on China, and also vary by type of goods and services (e.g., oil and natural gas versus local services).

Looking further forward, this stagflationary environment is ripe for instability and volatility over the coming decade as policy makers will be challenged to achieve their mandates with pressures on them coming from all sides. To make matters worse, policy makers seem to have an inadequate understanding of the forces at work (e.g., see the Jackson Hole speeches last August), which raises the odds of continued policy errors.

The views expressed herein are solely those of Bridgewater as of the date of this report and are subject to change without notice. Bridgewater may have a significant financial interest in one or more of the positions and/or securities or derivatives discussed. Those responsible for preparing this report receive compensation based upon various factors, including, among other things, the quality of their work and firm revenues

Bridgewater Daily Observations is prepared by and is the property of Bridgewater Associates, LP and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives or tolerances of any of the recipients. Additionally, Bridgewater’s actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This report is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned.

Bridgewater research utilizes data and information from public, private and internal sources, including data from actual Bridgewater trades. Sources include, Arabesque ESG Book, Bloomberg Finance L.P., Bond Radar, Candeal, Capital Economics, CBRE, Inc., CEIC Data Company Ltd., Clarus Financial Technology, Conference Board of Canada, Consensus Economics Inc., Corelogic, Inc., Cornerstone Macro, Dealogic, DTCC Data Repository, Ecoanalitica, Empirical Research Partners, Entis (Axioma Qontigo), EPFR Global, Eurasia Group, Evercore ISI, Factset Research Systems, The Financial Times Limited, FINRA, GaveKal Research Ltd., Global Financial Data, Inc., Harvard Business Review, Haver Analytics, Inc., Institutional Shareholder Services (ISS), The Investment Funds Institute of Canada, ICE Data, ICE Derived Data (UK), Investment Company Institute, International Institute of Finance, JP Morgan, MarketAxess, Medley Global Advisors, Metals Focus Ltd, Moody’s ESG Solutions, MSCI, Inc., National Bureau of Economic Research, OAG Aviation, Organisation for Economic Cooperation and Development, Pensions & Investments Research Center, Refinitiv, Rhodium Group, RP Data, Rystad Energy, S&P Global Market Intelligence, Sentix Gmbh, Shanghai Wind Information, Sustainalytics, Swaps Monitor, Totem Macro, Tradeweb, United Nations, US Department of Commerce, Verisk Maplecroft, Visible Alpha, Wells Bay, Wind Financial Information LLC, Wood Mackenzie Limited, World Bureau of Metal Statistics, World Economic Forum, YieldBook. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.