Link para o artigo original:https://www.oaktreecapital.com/insights/insight-commentary/market-commentary/the-roundup-top-takeaways-from-oaktrees-quarterly-letters-march-2024

The broad rally that boosted many leveraged credit and equity markets in the fourth quarter continued through the last three months, even as one of the main drivers of market optimism – expectations regarding near-term interest rate cuts – continued to shift. In the current installment of The Roundup,1 Oaktree examines the risks and opportunities in various asset classes at a moment when many investors are waiting to see whether this long-awaited dovish turn will actually materialize.

1

Market Outlook:

The Waiting Game

When we spoke with clients at the end of 2023, we argued that credit investors had grown too complacent. As we survey the current credit landscape, we’d like to second that assessment. In the last six months, leveraged credit markets have experienced what we call a “lift-a-thon” – almost everything has rallied. High yield bond spreads are currently the slimmest we’ve seen in almost two years, nearly three-quarters of leveraged loans are trading at or above 99 cents on the dollar, and new deals in the private credit market are offering average yield spreads that are roughly 100-125 basis points below those seen 12 months ago.2 While this rally has hit a few speed bumps in the first quarter – due to stickier-than-expected inflation – the positive trend persists.

This market strength obviously has multiple drivers – including supportive technicals – but, at its core, it appears to reflect investors’ belief that the U.S. is on the path to a soft landing that will lead to a meaningful decline in interest rates. While we aren’t overly bearish about the U.S. economy or the country’s inflation outlook, we believe downside surprises are currently much more likely than upside shocks, given that markets have already priced in optimistic expectations.

In particular, we’re doubtful that interest rates will decline as rapidly – or as substantially – as many investors anticipate, unless the U.S. experiences a serious recession or other crisis. If economic growth continues, inflation keeps slowing, and the unemployment rate stays within a reasonable range, then the Fed will have little reason to act aggressively. Instead, it’s much more likely to remain patient, especially in an election year.

Now, we do think it’s reasonable to assume that interest rates will decline modestly over the next two years, given disinflationary trends, but we think the fed funds rate is more likely to settle in the 2-4% range as opposed to 0-2%.3 This is significant because we believe many leveraged companies will have trouble refinancing their debt as long as interest rates remain above 2%. As a result, we believe the universe for opportunistic credit will grow even larger in the coming years, while skilled performing debt investors will continue to enjoy operating in a credit picker’s market.

2

Opportunistic Credit:

Rescue Me

In 2023, many companies began to feel the full impact of the spike in interest rates, as they found themselves saddled with unsustainable balance sheets, debt that couldn’t be easily refinanced, and/or near-term liquidity issues. But a substantial percentage were able to avoid default or restructurings and access much-needed liquidity through rescue financings, which are consensual, often bilateral arrangements. While the need for rescue capital has been – and continues to be – immense, the number of creditors with the scale and expertise needed to provide these solutions is low. As a result, rescue financings are now offering some of the best risk/reward profiles we’ve seen in our careers.

Just compare the average characteristics of the existing and new debt instruments involved in these rescue financings. The existing debt often (a) was issued with yields in the mid-single digits, (b) was governed by loose creditor agreements, and (c) didn’t offer claims on the companies’ most valuable assets. On the other hand, the new debt instruments being created through rescue financings in the current environment typically feature (a) yields4 in the mid-teens to low-twenties; (b) significantly superior collateral; and (c) stronger creditor protections, such as restrictions against the type of aggressive liability management exercises that can effectively strip collateral from existing lenders.5

Importantly, we think balance sheet challenges – and thus the need for rescue financings – will persist even if interest rates decline modestly in the next year. Bank of America recently released a study examining a group of 230 private issuers rated B or CCC that have a combined $400 billion of debt maturing through mid-2027. They noted that 30% of these issuers will have negative free cash flow even if the Fed cuts interest rates by 250 basis points over the next 12 months, while 40% will have negative FCF if the Fed is less dovish and only cuts by 75 bps during this period.6

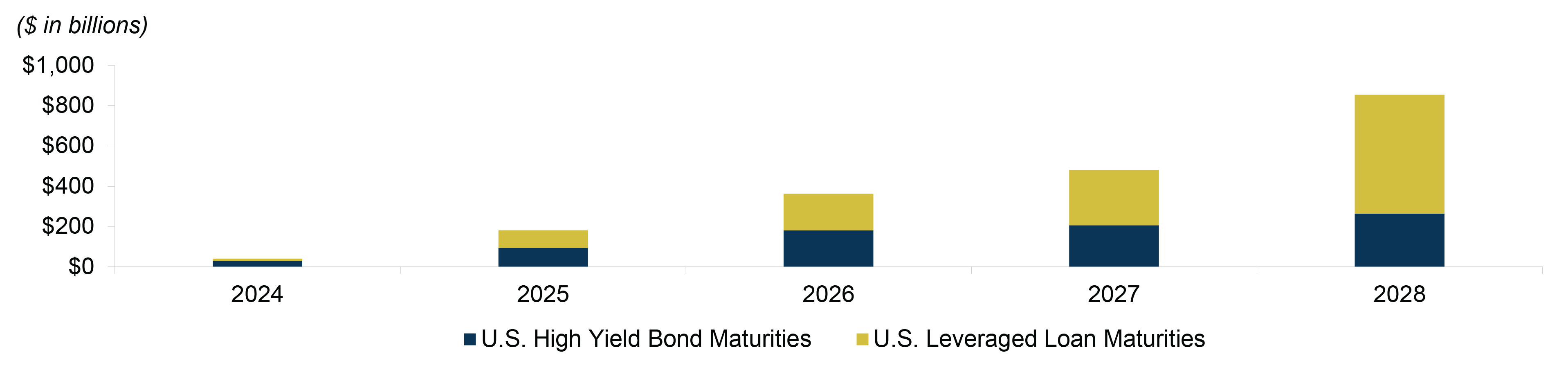

Meanwhile, refinancing risk remains elevated in U.S. leveraged credit. Even though maturities in these markets total only $40 billion in 2024, the figure jumps to roughly $180 billion, $365 billion, and $480 billion in 2025, 2026, and 2027, respectively.7 (See Figure 1.)

In short, we believe that (a) rescue financings will continue to represent a substantial portion of opportunistic credit deals and (b) those investors capable of coming to the rescue will be able to structure instruments with advantages that simply can’t be replicated in the liquid credit markets.

Figure 1: The Maturity Wall Is Looming Over U.S. Leveraged Credit Markets

Source: JP Morgan, as of February 14, 2024

3

Private Credit:

Next Frontier

In the last two years, increased regulations, rising interest rates, quantitative tightening, and risk aversion have caused commercial banks to limit the size and variety of their asset financing activities. This has opened the door for alternative lenders, especially in one vast segment of private credit: asset-backed finance.

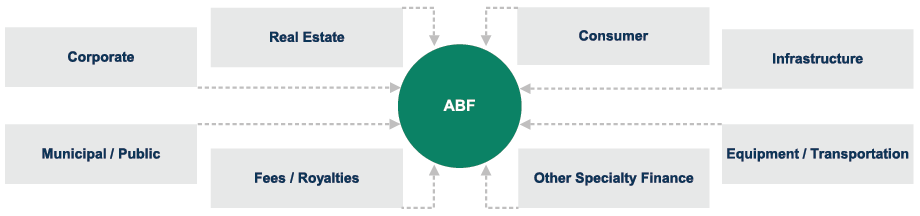

ABF refers to lending against, or investing in, pools of contractual assets, such as equipment leases, consumer loans, residential mortgages, and royalty agreements. (See Figure 2.) One of the key attractions of the $5 trillion+ market is the diversity of the underlying collateral.8 Traditional direct lending typically provides financing to individual middle-market companies that are owned by private equity sponsors. However, ABF securities are backed by a diverse set of borrowers representing a wide swath of the U.S. economy.

Additionally, ABF assets are contractual payment obligations, meaning they generate predictable cashflows, which isn’t the case with many physical assets. Thus, ABF investors are typically able to recoup a substantial portion of their capital in a timely fashion, even in the absence of a refinancing.

ABF also typically offers meaningful structural protections. For example, if the value of the underlying assets declines meaningfully, cashflows in the structure are usually redirected to pay off the most senior lenders, and forced asset sales or contentious negotiated restructurings are typically avoided. Additionally, as we noted above, the collateral is highly diverse, which reduces the risk posed by idiosyncratic issues that may impact a handful of assets. Moreover, the significant cash flows that an ABF investor receives – including both interest and amortization payments – help to de-risk the investment as it’s being held.

In recent years, ABF has been transformed from a low-return, bank-dominated asset class into a highly attractive area of opportunity for alternative lenders. Importantly, we believe that the prime drivers of this transformation – namely increased regulations and the end of the zero-interest-rate era – are secular shifts, not short-term trends. Thus, we believe ABF isn’t a short-term opportunity, but rather the next frontier of private credit.

Figure 2: ABF Includes a Wide Range of Asset Types

4

Real Estate Income:

A Shot in the Arm

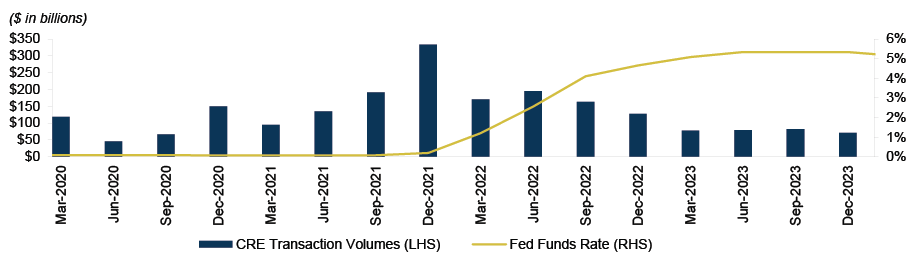

Transaction volumes in the U.S. real estate market could potentially get a boost from the Federal Reserve. Loosening monetary policy not only puts upward pressure on real estate valuations, but it also tends to have a positive impact on price discovery and liquidity by increasing transaction volumes – a trend we believe could play out in the coming years.

As the fed funds rate has risen over the last two years, real estate transaction volumes have plummeted: total activity fell by 52% year-over-year in 2023, after declining by 13% in the prior year.9 (See Figure 3.) But there are signs that the interest rate environment could be shifting. In March, the Fed held its policy rate steady for the fifth consecutive meeting and signaled that the Fed expects to cut interest rates multiple times in 2024.

If this modest dovish shift occurs, it should reduce uncertainty about the trajectory for interest rates and, in so doing, gradually bring investors back into the real estate market and increase transaction volumes. This, in turn, is likely to lead to greater price discovery, which should eventually encourage even more investors to come off the sidelines, creating a virtuous cycle over the medium term. The greatest beneficiaries of this trend are liable to be parts of the market with relatively robust fundamentals, such as high-quality core and core-plus real estate assets (i.e., those requiring limited improvements) in the strongest sectors.

Even though the most vulnerable segments of the real estate market may remain under stress in the coming years, a dovish shift by the Fed – even if it’s modest – has the potential to benefit investors in performing real estate by injecting some much-needed life into a stagnant market. While we obviously don’t know exactly how the Fed will act in 2024, what we do know for sure is that we’re far more optimistic about the outlook for core and core-plus real estate today than we were at the beginning of 2023.

Figure 3: Transaction Volumes Appear to Be Inversely Correlated with the Fed Funds Rate

Source: RCA, Federal Reserve, as of December 31, 2023

5

Global Convertibles:

Magnificent 700

While global convertibles underperformed global equities by over 12% in 2023,10 we believe this short-term relative weakness has improved the long-term prospects for the asset class. We’re confident in this for a few key reasons: (1) the reasonable valuations of the underlying equities on an absolute basis and in relation to the issuers’ long-term growth prospects, (2) the high coupons and low premiums available in this market, and (3) the robust pace and high-quality of new issuance.

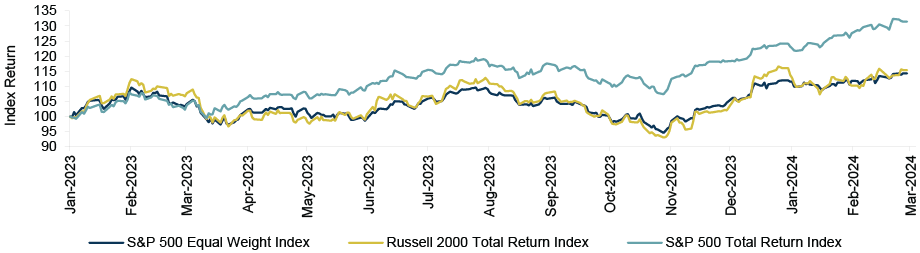

Even though the S&P 500 Index enjoyed a robust rally in 2023, driven by the strength of the “Magnificent Seven” (Apple, Alphabet, Amazon, Microsoft, Meta, Nvidia, and Tesla), the indices that are closely correlated with the convertibles markets – most notably U.S. small-cap stocks – lagged behind. (See Figure 4.) In fact, valuations in the latter still remain well below their 2021 highs: the price-to-book ratio of U.S. small caps is only 2x, less than half the level in the S&P 500.11

At the same time, global convertibles are offering investors better economic terms than they did only a few years ago. Average coupons in the convertibles market have risen to 2.8%, which is 140 basis points higher than the average at the end of 2021. Meanwhile, premiums in the convertibles market are 560 bps below the pre-pandemic average, meaning investors aren’t paying as much for the conversion option.12

Next, the size of the convertibles market increased in 2023, and the quality simultaneously improved. Companies seeking new capital or those looking to refinance straight debt often turned to the convertibles market because coupons here – though higher than they were a few years ago – are still roughly 230 bps below those in the high yield bond market. As a result, issuance in the asset class rose to $79 billion in 2023 – double the amount in the prior year. Importantly, more than 25% of this was rated investment grade, and issuers with market caps above $10 billion made up over 70% of this new issuance, a level that hasn’t been reached in more than a decade.13

In short, global convertibles appear to be offering investors a better product for a lower price, a market opportunity that doesn’t come around too often.

Figure 4: Small-Cap U.S. Stocks Continue to Underperform

Source: Bloomberg

6

Emerging Markets Equities:

Piling On

The current market narrative about the “uninvestability” of China reminds us of a recent comment from our co-chairman Howard Marks: “If you have two piles of assets – one with things that everyone loves, that are priced well and performing well, and the other with assets that everyone dislikes, that have poor price performance and are believed to be troubled – you have to ask yourself where will you find the best opportunities?” The answer is clearly in the latter.

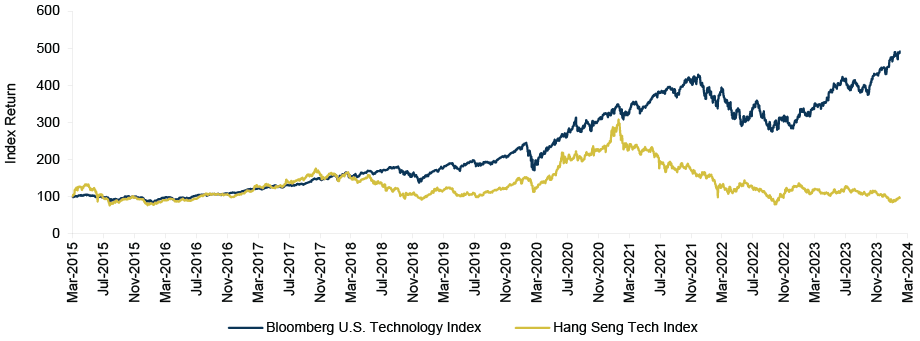

Chinese equities may be at the top of the “disliked and troubled” pile today. They are currently trading at a record-low 8.2x forward estimated earnings, on average,14 and the gap between U.S. and Chinese technology stocks is the widest it has been in many years.15 (See Figure 5.) Moreover, sentiment regarding investment in China is as bad as we’ve ever seen it, with global positioning surveys showing China to be a large consensus underweight. Counterintuitively, many investors who favored Chinese equities a few years ago when large Chinese companies were often being very aggressive in their use of capital, now consider the same equities to be too risky, even though the companies involved have become much more conservative and the equities themselves have become much less expensive.

Importantly, we think many high-quality Chinese companies are being punished not because of concerns about their fundamentals, but because of broad macro concerns about China. In fact, the fundamentals of many companies are actually improving. For example, net cash positions at the top 15 Chinese companies in the MSCI Emerging Markets Index have risen from negative $19 billion in 2019 to $113 billion in 2023.16

Far from worsening the investment outlook in China, we believe that this bear market has dramatically improved the long-term investment prospects for those capable of identifying value in a complex market. To paraphrase another quote from Howard, we prefer to buy things when they’re on sale, not after they’ve been marked up.

Figure 5: Chinese Technology Stocks Are Dramatically Underperforming Their U.S. Counterparts

Source: Bloomberg

ENDNOTES

- 1The content is derived from or inspired by ideas in 4Q2023 letters or other materials sent to clients in 1Q2024; the text has been edited for space, updated, and expanded upon where appropriate.

- 2ICE BofA US High Yield Constrained Index, as of February 29, 2024. Credit Suisse Leveraged Loan Index, as of February 29, 2024. Private credit based on Oaktree observations in the market, as of February 29, 2024.

- 3Oaktree Co-Chairman Howard Marks discussed this view in detail in his recent memo, Easy Money.

- 4This refers to the yield-to-two-year-call.

- 5Based on Oaktree observations in the market, as of February 29, 2024.

- 6Bank of America, as of January 5, 2024.

- 7JP Morgan, as of February 14, 2024.

- 8Based on estimates from industry peers, as of October 26, 2023.

- 9Real Capital Analytics, as of February 29, 2024.

- 10Refinitiv Global Focus Convertible Bond Index (USD Hedged), FTSE All-World Total Return Index (Local Currency), as of December 31, 2023.

- 11Bloomberg, as of January 31, 2024.

- 12BofA Global Research, as of December 31, 2023.

- 13BofA Global Research, as of December 31, 2023.

- 14MSCI China Index, as of January 31, 2024.

- 15Bloomberg, as of January 31, 2024.

- 16Bloomberg, as of December 31, 2023. Represents the largest non-financial Chinese companies by market capitalization. Excludes companies that went public after 2019.

NOTES AND DISCLAIMERS

This document and the information contained herein are for educational and informational purposes only and do not constitute, and should not be construed as, an offer to sell, or a solicitation of an offer to buy, any securities or related financial instruments. Responses to any inquiry that may involve the rendering of personalized investment advice or effecting or attempting to effect transactions in securities will not be made absent compliance with applicable laws or regulations (including broker dealer, investment adviser or applicable agent or representative registration requirements), or applicable exemptions or exclusions therefrom.

This document, including the information contained herein may not be copied, reproduced, republished, posted, transmitted, distributed, disseminated or disclosed, in whole or in part, to any other person in any way without the prior written consent of Oaktree Capital Management, L.P. (together with affiliates, “Oaktree”). By accepting this document, you agree that you will comply with these restrictions and acknowledge that your compliance is a material inducement to Oaktree providing this document to you.

This document contains information and views as of the date indicated and such information and views are subject to change without notice. Oaktree has no duty or obligation to update the information contained herein. Further, Oaktree makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss.

Certain information contained herein concerning economic trends and performance is based on or derived from information provided by independent third-party sources. Oaktree believes that such information is accurate and that the sources from which it has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. Moreover, independent third-party sources cited in these materials are not making any representations or warranties regarding any information attributed to them and shall have no liability in connection with the use of such information in these materials.

© 2024 Oaktree Capital Management, L.P.

Informações sensíveis e divulgação

Este memorando expressa as opiniões do autor na data indicada e tais opiniões estão sujeitas a alterações sem aviso prévio. A Oaktree não tem a obrigação de atualizar as informações aqui contidas. Além disso, a Oaktree não faz nenhuma representação, e não se deve assumir que o desempenho dos investimentos passados é uma indicação de resultados futuros. Além disso, onde quer que haja potencial de lucro, também existe a possibilidade de prejuízo. Este memorando está sendo disponibilizado apenas para fins educacionais e não deve ser usado para qualquer outro propósito. As informações contidas neste documento não constituem e não devem ser interpretadas como uma oferta de serviços de consultoria ou uma oferta de venda ou solicitação de compra de quaisquer títulos ou instrumentos financeiros relacionados, em qualquer jurisdição. Certas informações contidas neste documento sobre tendências econômicas e desempenho são baseadas ou derivadas de informações fornecidas por fontes terceirizadas independentes. A Oaktree Capital Management, L.P. (“Oaktree”) acredita que as fontes das quais tais informações foram obtidas são confiáveis; no entanto, não pode garantir a exatidão de tais informações e não verificou de forma independente a exatidão ou integridade de tais informações ou as suposições nas quais tais informações se baseiam. Este memorando, incluindo as informações aqui contidas, não pode ser copiado, reproduzido, republicado ou postado na íntegra ou parcialmente, em qualquer formato, sem o consentimento prévio, por escrito, da Oaktree.